Shares of cancer drugmaker Mirati Therapeutics (NASDAQ:MRTX) soared over 45% yesterday. The upside can be attributed to French pharma giant Sanofi (NASDAQ:SNY) exploring the acquisition of MRTX. As per a Bloomberg report, the discussions regarding the deal are currently underway, but there is no assurance that an agreement will be finalized.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MRTX has been considered a potential acquisition target by large pharmaceutical companies since last year. Moreover, the company was rumored to be weighing some strategic options at the time. The departures of its CFO, Laurie Stelzer, in August and CEO David Meek earlier that month made the company more vulnerable to potential takeover bids.

It is worth highlighting that the acquisition talks come ahead of Mirati rolling out its first drug, Krazati, for the treatment of advanced lung cancer in adults. The U.S. Food and Drug Administration gave accelerated approval to MRTX’s drug in December. The drug is expected to compete against Amgen’s (AMGN) Lumakras, which was approved by the FDA in 2021.

The deal with SNY is expected to help Mirati better commercialize the treatment drug and support its additional research.

What is the Price Target for Mirati?

Overall, MRTX stock has a Moderate Buy consensus rating based on 10 Buy, four Hold, and one Sell ratings assigned over the last three months. At $51.80, the average MRTX stock price target implies downside potential of 17%. It’s possible that analysts have not updated their price targets for Mirati stock in response to its recent surge in price.

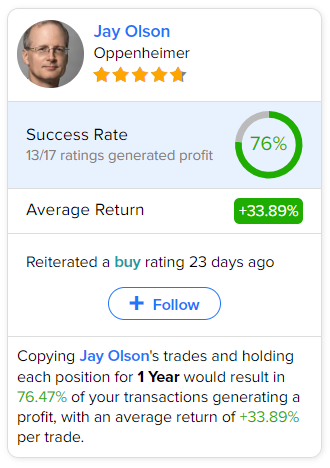

Investors looking for the most successful analyst covering MRTX stock could follow analyst Jay Olson from Oppenheimer. If one were to replicate Olson’s trades on Mirati and hold each position for one year, about 76% of the transactions would result in a profit with a massive average return of 33.89%.