Refining oil is a dangerous process. That’s a lot of why companies like BP (NYSE:BP) are pretty heavily regulated in terms of what safety practices they should follow. And when an accident took the lives of two workers at a Husky oil refinery in Ohio—brothers Max and Ben Morrissey—it meant bad news for BP, sending share prices down in Friday’s trading.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The deaths of two workers will cost BP over $150,000 in fines, as OSHA representatives found a lack of proper training and protocols for hazardous materials. Shutdown procedures were also lacking, based on an incident that featured flammable naphtha getting into refinery gas systems. That combination created an explosive vapor cloud which, subsequently, exploded.

This is just the latest problem for BP, whose Deepwater Horizon oil platform—which featured 11 deaths—has so far cost the company better than $60 billion in lawsuits. More are still coming, as BP paid $1.4 billion in damages and compensation last year, and expects to pay roughly the same costs–$1.3 billion—this year.

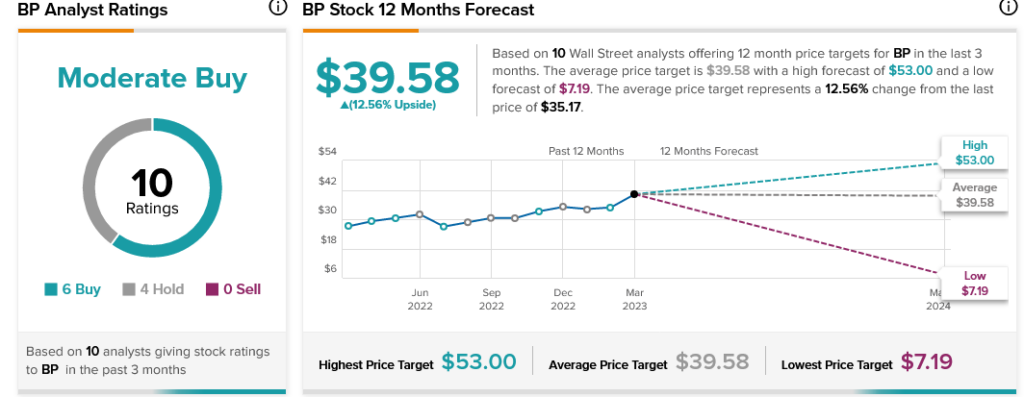

Wall Street, meanwhile, remains in BP’s corner. Analyst consensus currently calls BP stock a Moderate Buy. With an average price target of $39.58, BP stock enjoys 12.56% upside potential.