BP plc (GB:BP) (NYSE:BP) stock jumped over 6% in early morning trading after the British oil and gas major announced robust share buybacks and boosted dividends, even as 2023 profits declined significantly due to lower energy prices. BP plans to execute an accelerated share repurchase of $1.75 billion before Q1 2024 results, with a $3.5 billion share buyback plan for the first half of 2024. Plus, BP increased the dividend for Q4 2023 by 10% year-over-year to $7.27 per share.

Overall, BP intends to execute share buybacks of at least $14 billion through 2025 as part of its target to return at least 80% of excess cash flow to shareholders.

Details About BP’s 2023 Results

BP’s underlying replacement cost profit (similar to net income) of $13.8 billion for Fiscal 2023 fell significantly from $27.6 billion in the prior year.

In Q4, BP’s underlying replacement cost profit of $2.99 billion came in better than analysts’ expectations but was down 37.8% year-over-year. The oil giant attributed the better-than-anticipated performance to the sequential improvement in oil and gas prices and favorable gas trading, partially offset by weak industry refining margins, lower oil trading, and exploration write-offs.

Meanwhile, BP’s capital expenditure was almost flat at $16.25 billion in 2023. The company expects annual capital expenditure of around $16 billion in 2024 and 2025, in line with its medium-term target of $14 to $18 billion.

BP continues to strengthen its balance sheet. The company reduced its net debt to $20.9 billion in 2023 from $21.4 billion in the prior year.

Is BP a Good Share to Buy?

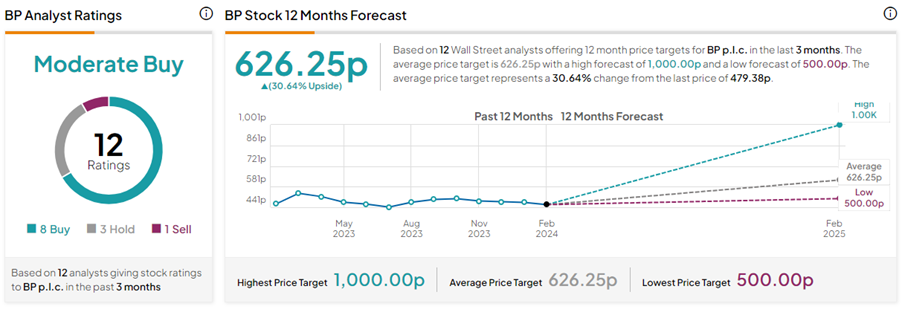

Following BP’s Q4 print, RBC Capital analyst Biraj Borkhataria reiterated a Buy rating on BP stock, with a price target of 600p (24.9% upside). Borkhataria is impressed with BP’s commitment to execute strong share repurchases by 2025. The analyst believes this is a sign of confidence in BP’s future performance.

On TipRanks, BP stock has a Moderate Buy consensus rating backed by eight Buys, three Holds, and one Sell rating. The BP plc share price forecast of 626.25p implies 30.6% upside potential from current levels.