Apparently, when even Congress starts getting involved in your labor relations issues, you end up taking it seriously. Aerospace stock Boeing (BA) is rolling out another contract offer for its St. Louis contingent, hoping to get everybody back to work and turning out military aircraft. Now all that remains is to see if the union will take the offer. Investors were not especially pleased, though, as shares dipped fractionally in Monday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The latest reports say that the new contract comes with a larger ratification bonus for approving it, as well as a few other changes. The bonus actually doubled, going from its previous $3,000 to $6,000, and also removed some of the restrictions on stock units. However, Boeing also kept the planned wage increases at 24% over the course of five years.

Word from Steve Palmer, Boeing’s defense chief, says that the new contract raised average base pay substantially, going from $75,000 a year to $109,000. The union is set to vote on the contract on Wednesday, so at least we will hear how it goes one way or another soon. Meanwhile, Boeing also noted that its intent to hire replacement workers have gone according to plan, with some areas currently fully staffed. But, if the contract offer is ratified, none of the union members will be let go.

Groundbreaking

Further, we heard last week about Boeing’s plan to ramp up operations in South Carolina. Reports note that this plan is moving along rapidly, as Boeing broke ground on the project on Friday. Once complete, the facility will get an extra one million square feet of production space, including office space, airplane production, and production support spaces.

The Interiors Responsibility Center will get an upgrade, allowing for more construction of 787 interior components, and a vertical fin paint facility along with Flight Line stall and a preparation area will be added on. Boeing will need all that extra space, as it plans to bolster its Dreamliner production to 10 per month starting next year.

Is Boeing a Good Stock to Buy Right Now?

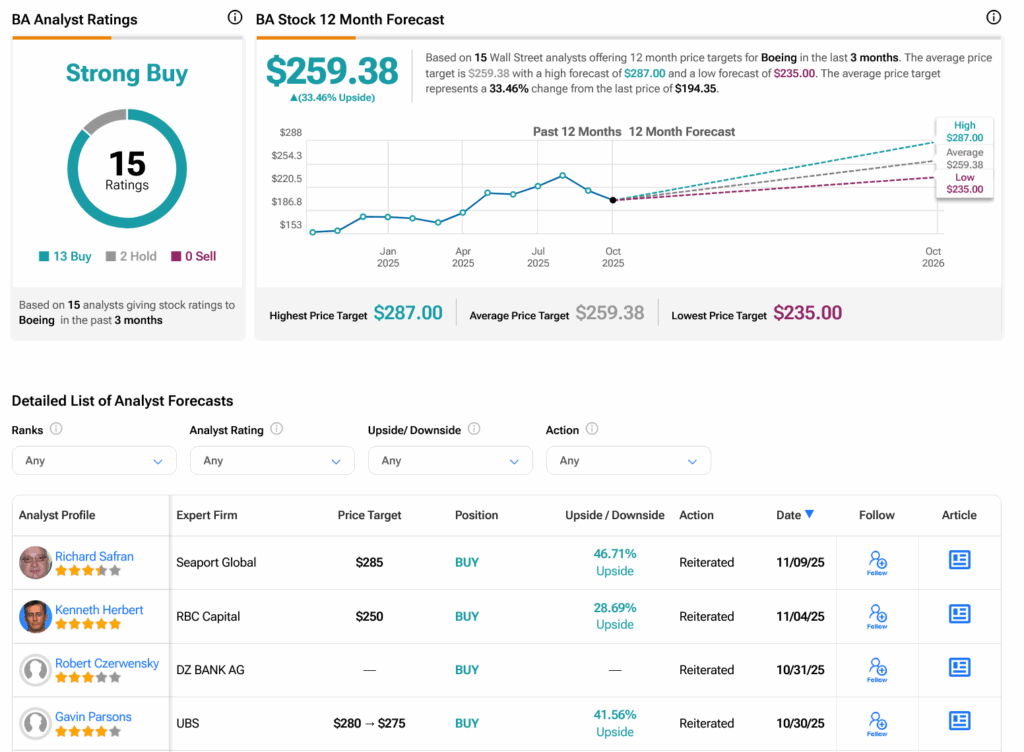

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 13 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 30.65% rally in its share price over the past year, the average BA price target of $259.38 per share implies 33.46% upside potential.