The St. Louis strike is getting to be a real problem for aerospace stock Boeing (BA), as even denizens of Congress are starting to take notice. More notice than they were previously, even. While elements of the government were already on record as opposing the plan to use replacement workers, Boeing is now facing calls from the United States Senate to get its striking workers back to work. The news hit Boeing shares hard, and sent them down nearly 3% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Five Democratic Senators—who apparently had time to do this sort of thing with the government still shut down and all—sent a letter out Kelly Ortberg’s way, and had very little positive to say in said letter. Specifically, the letter declared, “For existing projects, such as the F-15 Eagle and the F/A-18 Hornet, you are also unnecessarily endangering our warfighters by insisting on proceeding with an untrained and hastily recruited workforce.”

The Democratic Senators were not alone here, either, as Josh Hawley of Missouri also had his own letter to Ortberg. That letter called on Ortberg to return to proper good-faith negotiation with the striking workers. One part of the letter read: “These workers help produce our Nation’s most crucial, most advanced, and most expensive defense tools. And since your company receives billions in government contracts, it is incumbent upon you to do the right thing.”

Analyst Upgrade

But not all the news was so bad. Analysts at Freedom Capital gave Boeing an upgrade in two different directions. The analysts upgraded Boeing from Hold to Buy, and then upgraded the price target as well, going from its original $217 per share to $223 per share.

As for reasons, several factors chipped in at once, and they all added up to one key takeaway: a likely recovery in the making. Boeing’s operational performance is improving, based on the results of the third quarter earnings numbers, and regulators seem to be increasingly confident as well, based on the rise in the production cap. All of these points together combined to form a “cautious recovery,” as revealed by a research note.

Is Boeing a Good Stock to Buy Right Now?

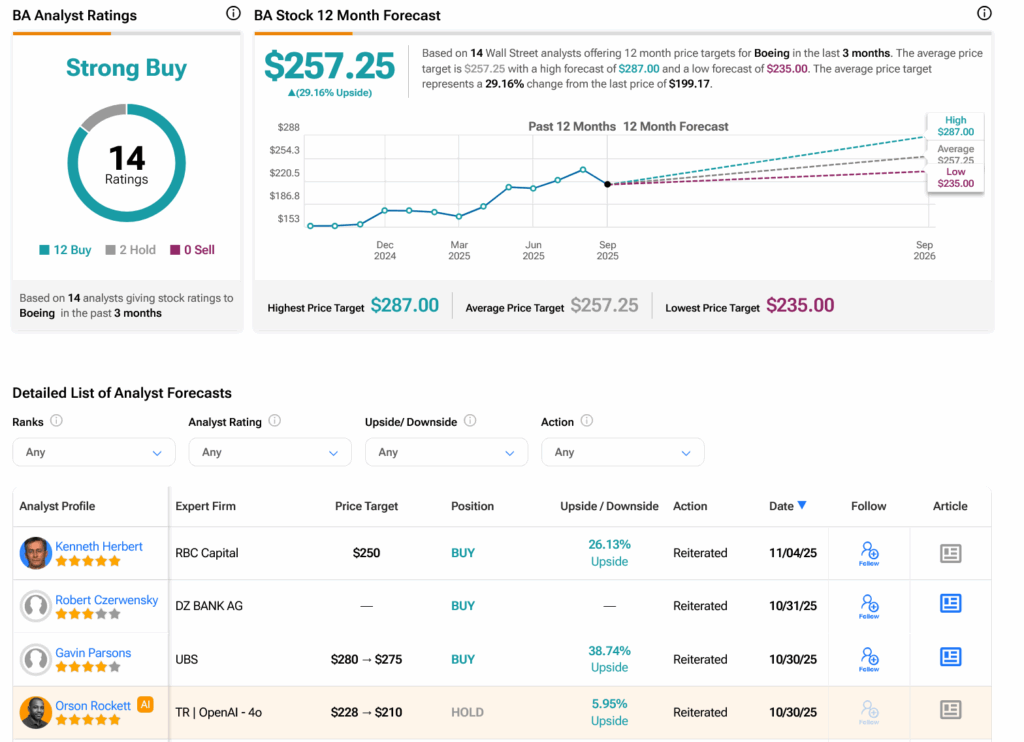

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 12 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 35.46% rally in its share price over the past year, the average BA price target of $257.25 per share implies 29.16% upside potential.