The FAA (Federal Aviation Administration) issued an EAD (Emergency Airworthiness Directive) mandating the temporary grounding of numerous Boeing (NYSE:BA) 737 MAX 9 aircraft for thorough inspections. This decision followed an incident during an Alaska Airlines (NYSE:ALK) flight, where a piece of the plane dislodged mid-flight. While investigators are currently concentrating on the Alaska Airlines incident and are not extending their inquiry to the broader Boeing 737 MAX fleet, it’s important to analyze the impact of this incident on Boeing stock.

It is projected that the FAA’s directive will impact approximately 171 planes globally. However, it is specifically expected to affect U.S. airline companies like Alaska and United Airlines (NYSE:UAL), the two largest users of the Boeing 737 MAX 9. Both companies grounded their entire fleets of MAX 9.

Goldman Analyst Sees No Impact on Boeing Stock

Goldman Sachs analyst Noah Poponak termed the incident as “alarming.” However, the analyst reiterated a Buy on Boeing stock on January 7.

Poponak said that grounding the entire MAX 9 fleet raises concerns, particularly regarding the timeliness and nature of corrective measures. However, the analyst remained optimistic and added that the operators have stated the inspection time is relatively short at 4-8 hours. Additionally, Poponak noted that the current focus is potentially on installation-related corrections rather than issues stemming from the manufacturing process.

The analyst emphasized that quality control issues would pose a risk to the production and delivery schedules. Nonetheless, there’s a possibility that these issues are confined to a specific scenario with limited repercussions in the short term, said Poponak.

What is the Prediction for Boeing Stock?

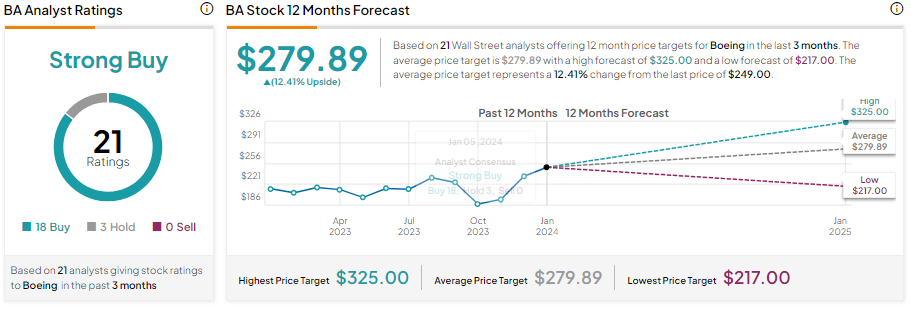

Wall Street analysts are bullish about its prospects. The stock has 18 Buys and three Hold recommendations for a Strong Buy consensus rating.

BA stock has gained over 19% in one year. Meanwhile, analysts’ average price target of $279.89 implies 12.41% upside potential over the next 12 months.