European aircraft manufacturer Airbus (EADSY), which recently dethroned Boeing (BA) to emerge as the maker of the world’s most popular passenger aircraft, is now expanding its operations in China.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company on Wednesday launched its second final assembly line (FAL) located in Tianjin, a port city more than 100 miles southeast of Beijing, Reuters reported. This comes just about a week after the aircraft designer cut the ribbon on its second facility of the same line in Alabama, U.S.

Airbus Aims for Global Expansion

The moves are part of Airbus’s efforts to intensify its global expansion. The company delivered more than double Boeing’s aircraft output last year.

The France-based manufacturer has said that the second FAL in China will help the company ramp up the production of the A320neo — the family of single-aisle jets that helped Airbus surpass Boeing’s 737 family to become the world’s best-selling airliner earlier this month.

With the launch of an additional FAL in China and the U.S., Airbus now boasts 10 such facilities for its commercial aircraft business, with other lines located in France, Germany, and Canada.

Experts have pointed out that the close timing of both launch events suggests that Airbus is using the events to navigate ongoing trade tensions between the U.S. and China, according to the outlet.

Is It Better to Invest in Airbus or Boeing?

Turning to Wall Street, EADSY stock currently has a Moderate Buy consensus rating based on a single Buy rating from one analyst in the last three months. However, TipRanks’ AI Stock Analyst Spark ranks the ADR shares with an Outperform grade, giving it a score of 76 out of 100.

Spark points to the company’s strong financial performance and positive technical indicators. The AI stock analyst’s average EADSY price target of $61.00 suggests a potential growth rate of about 2%.

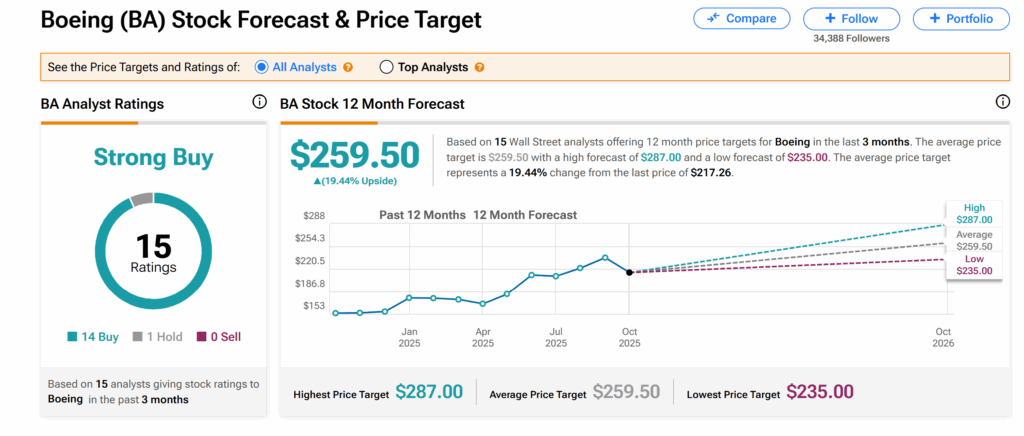

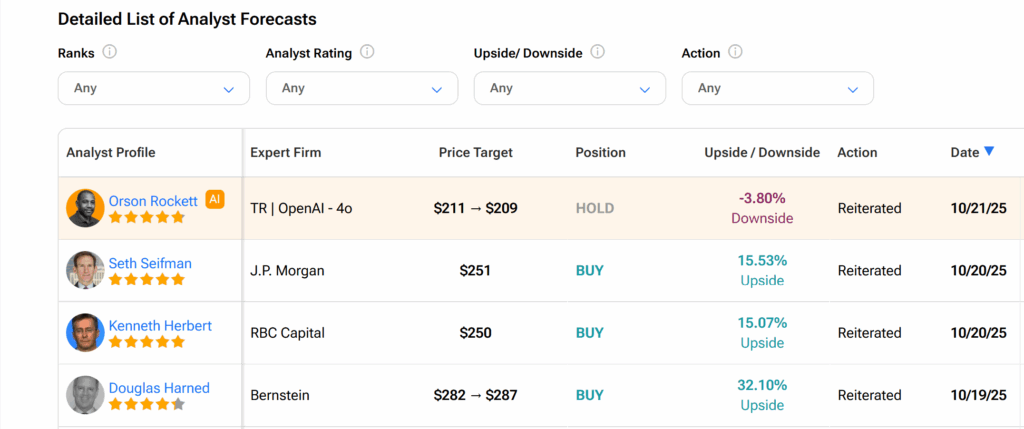

On the other hand, Boeing’s shares currently have a Strong Buy consensus recommendation from Wall Street. This is based on 14 Buys and one Hold issued by analysts over the past three months. Furthermore, at $259.50, the average BA price target indicates more than 19% upswing potential from the current level.