Later today, an event that should prove make-or-break for aircraft maker Boeing (NYSE:BA) will take place. The National Transportation Safety Board (NTSB) plans to release a report about the incident with the Alaska Airlines Boeing 737 Max 9 flight, and it should offer new insight into what happened and who was to blame. Boeing investors are confident, though, and shares are up modestly in Tuesday morning’s trading.

Boeing currently operates under a production cap, and 171 different Boeing Max 9 planes were grounded after the door panel incident took place. The grounded planes were inspected and returned to service shortly after, seemingly with nothing found amiss. Yet, word from both United Airlines (NASDAQ:UAL) and Alaska Air (NYSE:ALK) revealed that “loose parts” had been found on several grounded Max 9 jets.

The Trouble Didn’t Stop There

This would have been bad enough by itself. However, new reports emerged from Boeing that suggest the troubles don’t stop there. A worker noticed two holes in a Boeing fuselage that “…might not have been drilled according to specifications.” While Boeing itself doesn’t think that this would be a problem—it referred to the holes as “…not an immediate safety issue“—it did acknowledge that about 50 Boeing planes that hadn’t been delivered yet would have to have some “rework” done.

This will do Boeing very little good in an environment where people are already questioning if they want to get on a Boeing plane.

Is Boeing a Good Buy Now?

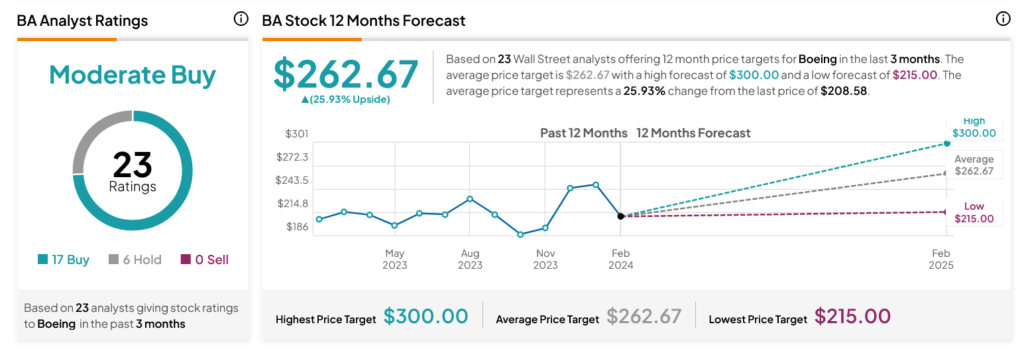

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 2.78% loss in its share price over the past year, the average BA price target of $262.67 per share implies 25.93% upside potential.