Well, all the drama and hand-wringing at Boeing (NYSE:BA) may be about to come to an end. It turns out that Boeing is ready to present its plan to regulators for consideration, and hopefully, it will get the aircraft maker back on track, filling orders and ending a catastrophic cash burn rate that looks like a forest fire in a bank account.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The report is being regarded as a key step forward in rebuilding lost trust, a point we talked about just a couple days ago. Boeing needs to prove that it can once more build airplanes in which chunks of the flight do not arrive at their destination before the passengers do, in some cases. This will naturally be difficult, especially with a surging number of small-scale internal whistleblowers filing reports on Boeing’s own reporting channels.

However, there’s not much word about what that report will include. Early reports suggest that some of the measures from the plan already found their way to the floor, as “…rework is lower, flow time is better, [and] traveled work is less,” noted Boeing’s Chief Financial Officer Brian West.

Trouble Through the Line

One of the biggest parts of the Boeing plan was to restrain Spirit AeroSystems (NYSE:SPR), telling it not to deliver fuselages before they’re complete. But that’s not the only supplier finding its output in question; Astronics, which focuses on electric power systems, noted that each 737 Max released contains about $95,000 worth of its products. Thus, roughly every 10 planes that don’t make it out of Boeing is another million dollars lost for Astronics. And it’s not the only one, either; Boeing’s slowdown could end up crippling its supply chain, even if it improves its own safety levels.

Is Boeing a Buy or Sell Stock?

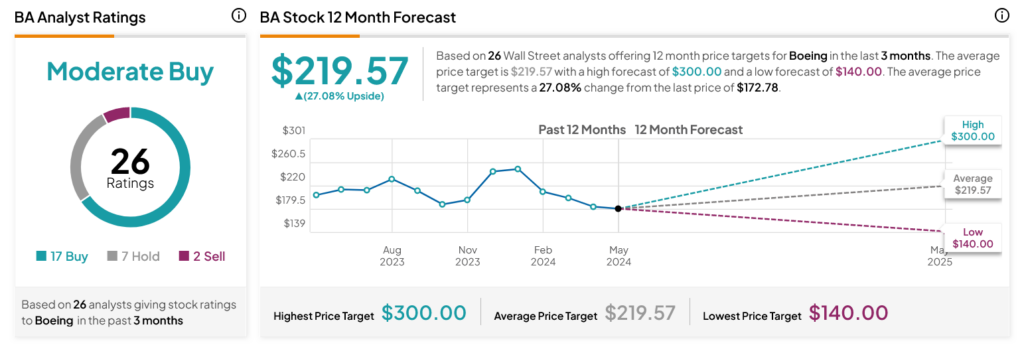

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 15.56% loss in its share price over the past year, the average BA price target of $219.57 per share implies 27.08% upside potential.