The rubber is about to meet the road for aircraft maker Boeing (NYSE:BA) as it released its annual safety report. And the numbers were, generally speaking, not good. They were particularly not good in the face of a report about to hit regulators’ desks on safety at Boeing, and investors responded accordingly. Shares were down fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reports noted that the Speak Up tool—a tool designed to allow employees to report safety concerns directly to Boeing—was being used significantly more often than normal in early 2024. In fact, there was a 500% rise in Speak Up usage not too long after the initial incident that started Boeing’s string of calamities, when a 737 Max 9 jet lost a door plug panel mid-flight.

What bearing that will have on the report about to go to regulators is uncertain at best, but it absolutely demonstrates the extent of the problem. That’s particularly true in light of the flood of incidents that followed.

And More Incidents Followed

Things only got worse for Boeing over the holiday weekend. 12 passengers on board a 787-9 Dreamliner were injured in a flight from Doha to Dublin, Ireland, when “turbulence” hit and sent some passengers flying into the cabin’s ceiling. Meanwhile, a “technical issue” sent a flight from London’s Heathrow to San Francisco turning around over Greenland.

The rising number of such incidents can’t help customer confidence in Boeing right now. It remains one of the critical items that Boeing needs to address soon lest it find its lunch eaten by new and old competitors alike.

Is Boeing a Buy or Sell Stock?

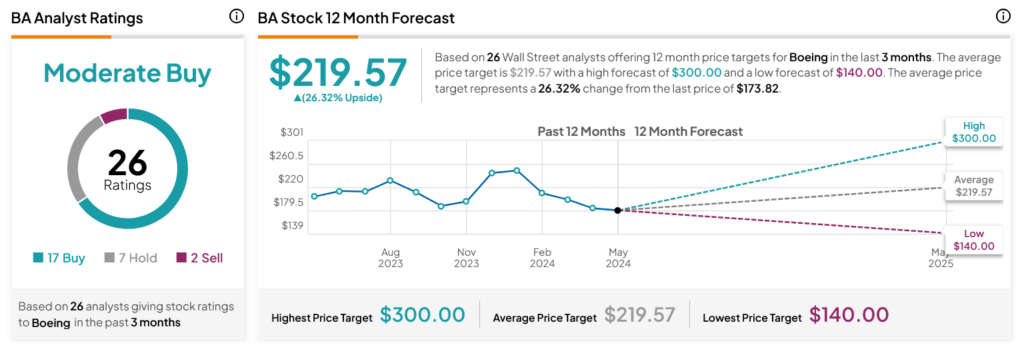

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 15.02% loss in its share price over the past year, the average BA price target of $219.57 per share implies 26.32% upside potential.