For anyone who thought 2024 was going to be aircraft maker Boeing’s (NYSE:BA) year, I have good news and bad news. The bad news is you’re going to be disappointed. The good news is you won’t be disappointed alone. New reports have the Federal Aviation Administration (FAA) tightening up on Boeing, and that sent shares down nearly 2% in Friday morning’s trading.

After the latest mid-air disaster featuring a 737 Max jet—in which a chunk of the plane broke off during flight—it’s not surprising to see the FAA picking up its inspection schedule on the beleaguered aircraft maker. Unfortunately, the news gets worse as Mike Whitaker, head of the FAA, revealed that there are “other manufacturing problems” within Boeing. A new audit is planned for the production line and Boeing’s suppliers. Based on how that audit turns out, there may be further audits to come as the FAA tries to piece together why Boeing’s planes seem to have the durability of wet tissues.

And It Gets Worse from There

It’s bad enough that the government is taking aim at Boeing, but it gets worse: the people on that flight are turning around and suing Boeing. A class action lawsuit emerged from the passengers of flight 1282. Everything from emotional trauma to property loss—one passenger reportedly had the shirt ripped off his back when the breach happened—took place as a result of that flight. That’s not going to be the kind of thing that gets quietly swept under the rug with a couple of free tickets and a few frequent flyer miles.

What is the Prediction for Boeing’s Stock Price?

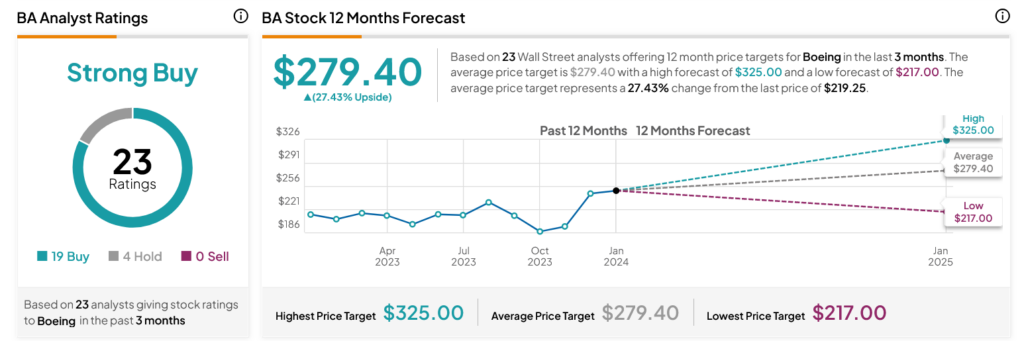

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 19 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 2.2% gain in its share price over the past year, the average BA price target of $279.40 per share implies 27.43% upside potential.