I would say the bad news just keeps on coming for aircraft maker Boeing (NYSE:BA), but based on its performance this afternoon, investors don’t have much trouble with it. This time around, Boeing’s credit rating took a hit from S&P, but despite this, investors sent shares up fractionally in Thursday afternoon’s trading.

S&P’s original credit rating on Boeing was “stable,” which isn’t particularly great, but not especially bad, either. But with today’s cut, S&P now ranks Boeing’s credit as “negative,” which reflects S&P’s lack of faith in Boeing’s ability to repay loans thanks to sluggish cash flow and faltering credit ratios. Now, Boeing’s credit is officially one step above junk status, and if it gets that bad, it could be a disaster for the company, as it would increase its cost of borrowing.

Worse, it’s not alone; Moody’s yesterday cut Boeing’s credit to that same one-step-above-junk level thanks to reports of Boeing’s accelerating cash burn rate. The next couple of years will be unpleasant for Boeing, as Moody’s noted that Boeing has a hefty $8 billion in debt coming due in 2026. Throw in persistent leadership issues at Boeing, and the terrifying package is complete.

Hope for Space?

A new revenue stream would be welcome for Boeing right now, and it may have it, as NASA astronauts are poised to fly the Boeing Starliner to the International Space Station (ISS). Currently, said astronauts are on their way to the launch site for the planned takeoff, which is set to hit on May 6, assuming nothing goes wrong with the schedule. Said flight will be a “crew flight test” mission that helps to clear Starliner for future use and could represent a shot in the arm for Boeing stock.

Is Boeing Stock a Buy, Sell, or Hold?

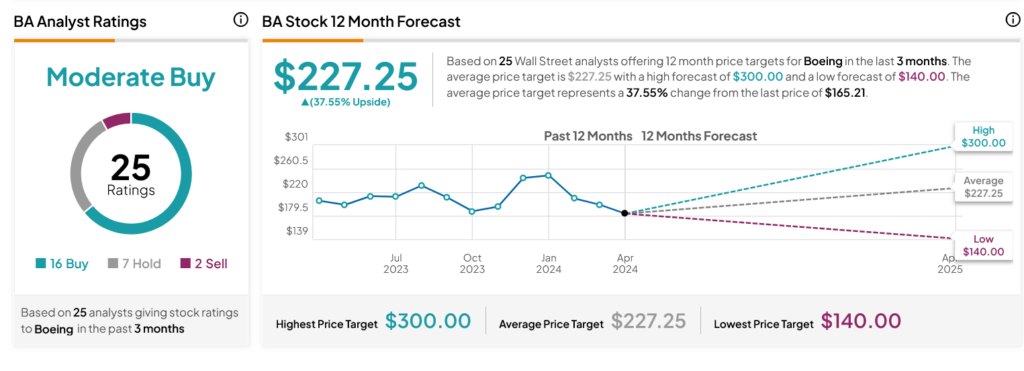

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 16 Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After an 8.4% loss in its share price over the past year, the average BA price target of $227.25 per share implies 37.55% upside potential.