Dish soap? Corn starch? Hotel key cards? These are not items you’d typically expect to find in the components of building an airliner. At aircraft maker Boeing (NYSE:BA), however, they were considered, and dish soap actually proved to be a winner in one case. That wasn’t encouraging news for investors, though, as shares slipped nearly 2% in Friday afternoon’s trading to build on the longest losing streak of days the stock has seen since 2018.

The problem for Boeing here comes from one of its key suppliers, Spirit AeroSystems (NYSE:SPR). Spirit recently revealed that it performed maintenance using a variety of unconventional materials that proved not only necessary but innovative. The report from Popular Science detailed how, during a recent Federal Aviation Administration (FAA) audit, Spirit turned to Dawn-brand dish soap as a lubricant in aircraft door seals.

Moreover, once the door had been apparently properly lubed up, Spirit turned to a standard hotel key card to check the seal. Spirit defended its practices in an interview with The New York Times. In said interview, Spirit noted that the chemical makeup of Dawn dish soap was apparently just right to prevent “tears or bulges from occurring during the seal’s installation.”

Delta Air Lines CEO Remains Confident in Boeing

Meanwhile, Boeing got a leg up from Delta Air Lines (NYSE:DAL), whose CEO, Ed Bastian, came out with a public statement declaring he has “…confidence in the company.” Bastian also referred to Boeing as both “strong” and “important,” and though he acknowledged it would take time to get its quality and performance back up to standards, he believed it could be done. Bastian specifically called out the recent change in leadership, which may prove helpful on that end.

Is Intel Stock a Buy, Sell, or Hold?

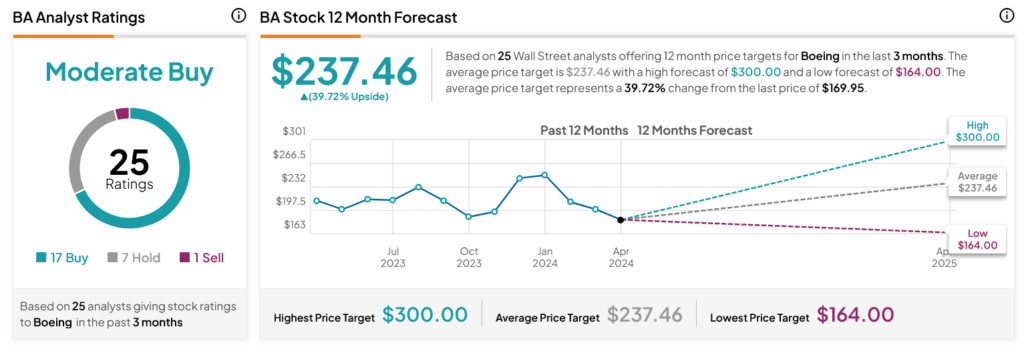

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 20.34% loss in its share price over the past year, the average BA price target of $237.46 per share implies 39.72% upside potential.