It’s no secret that aerospace company Boeing (NYSE:BA) has had troubles with its aircraft lately. However, it’s made a noteworthy advance in terms of how it fuels said aircraft. And that move has won it some new fans among investors, who sent Boeing shares up modestly in Tuesday afternoon’s trading.

Boeing announced plans to buy a whopping 9.4 million gallons of “…blended, sustainable aviation fuel…” for its 2024 commercial operations. It’s actually the largest amount of sustainable aviation fuel that Boeing has ever bought in one go, easily beating out the buy it made last year.

In fact, this year’s buy is 60% larger than the one it made in 2023. Boeing plans to use the sustainable fuel—reportedly a mix of 70% normal aviation fuel and 30% “waste by-products,” which includes various oils, fats, and greases—in its ecoDemonstrator program and in commercial flights throughout the United States.

Fighting the Whistleblowers

Meanwhile, Boeing came out with reports that refuted some recent whistleblower reports about the danger of its aircraft. Specifically, the 787 Dreamliner, which the whistleblowers claimed could break apart in flight. Boeing noted that the carbon-composite skin on the 787 Dreamliner is “…nearly impervious to metal fatigue.” Several planes have already had multi-year inspections; 671 Dreamliners have been subjected to six-year-old inspections, and eight have run through 12-year-old inspections with no signs of trouble.

Is Boeing Stock a Buy or Sell?

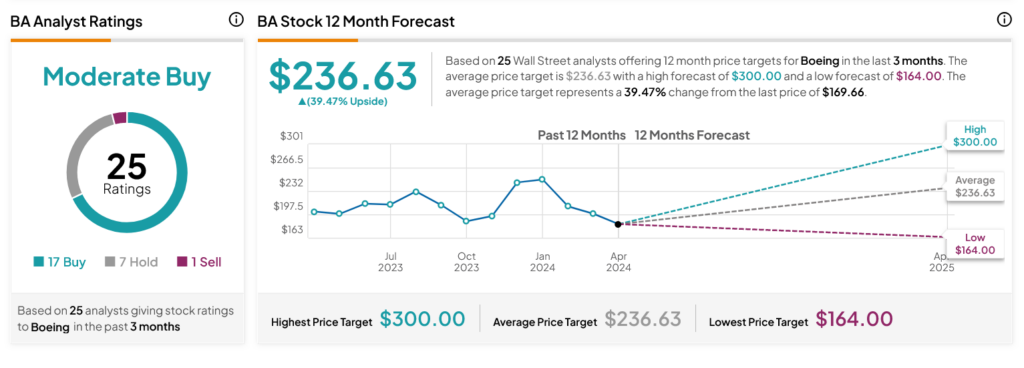

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 17.05% loss in its share price over the past year, the average BA price target of $236.63 per share implies 39.47% upside potential.