Despite some truly impressive performance at the recent Dubai Airshow, Boeing (NYSE:BA) investors were not excited about the outcome. Boeing blew them away at the big show, and came away with fistfuls of orders. Yet, in spite of this, Boeing is down fractionally in Thursday afternoon’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing hit the big show with something to prove, especially after a comparatively rough few years that featured not only travel restrictions from COVID-19, but also several mechanical issues that left some wondering if Boeing could ever truly recover. Given that Boeing’s only real competition in the field is Airbus (OTHEROTC: EADSF), that made it the prime metric to determine how well Boeing actually did. Airbus came away from the big show with 86 orders. Boeing, meanwhile, came away with 295, over three times what Airbus landed. Boeing landed orders from Emirates Airlines, FlyDubai, and several others.

Boeing’s Sales Go Beyond Commercial Planes

Boeing’s commercial sales were good news, but it didn’t stop there. NATO also stepped in, picking up six of Boeing’s E-7A Wedgetail models as a replacement for the E-3 AWACS. Given what’s been going on lately in Eastern Europe and the Middle East, it’s a small surprise that NATO might be looking to refresh some of its hardware. And NATO turned to Boeing to do the job. However, that particular deal will have a fairly long runway; the first of those E-7A Wedgetails is set to go online “…by 2031.” Odder still are the reports that NATO has 14 E-3A craft—all of which will be out of play in 2035—but NATO only ordered six replacements from Boeing.

Is Boeing a Buy, Hold, or Sell?

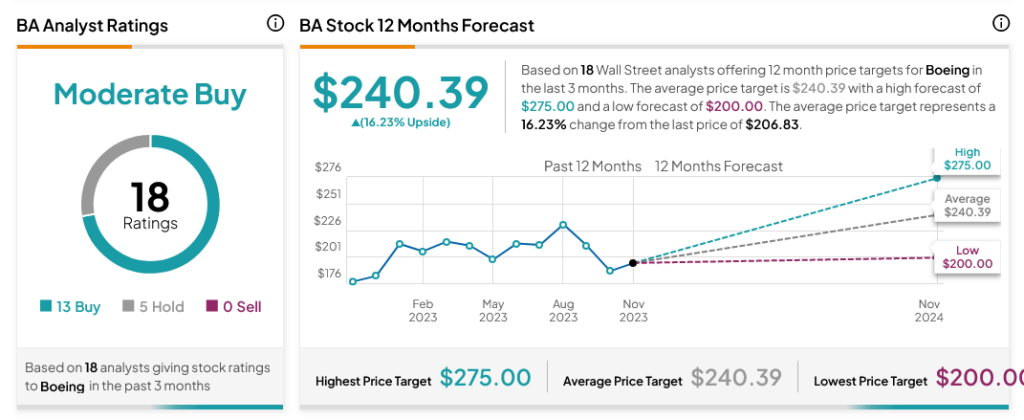

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 13 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 19.71% rally in its share price over the past year, the average BA price target of $240.39 per share implies 16.23% upside potential.