Aerospace company Boeing (NYSE:BA) gained in trading on Monday after Emirates Airline confirmed an order for 95 Boeing aircraft worth $52 billion at the Dubai Airshow. As part of this deal, Emirates will buy 55 of Boeing’s 777-9 aircraft and 35 of its 777-8 airplanes, bringing the airline’s total orders for Boeing’s 777X wide-body jets to 205 units.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In addition, Emirates also raised its order of Boeing 787 Dreamliners from 30 to 35 units.

The Middle East is increasingly becoming an important market for Boeing. According to a CNBC report, citing analysts at AllianceBernstein, the Middle East now accounts “for the largest portion of combined

Airbus and Boeing widebody passenger backlog at 30% of the global total.”

This deal comes amid another report that China could be warming up to Boeing and could end its freeze on the aerospace giant.

Is BA a Good Buy Right Now?

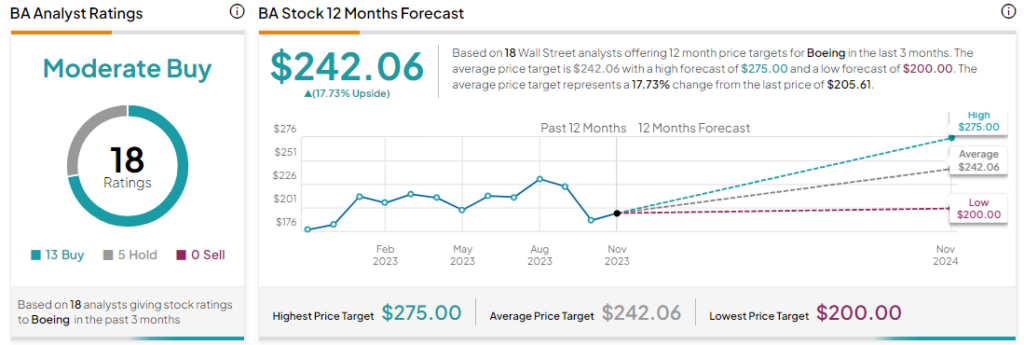

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 13 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 15% rally in its share price over the past year, the average BA price target of $242.06 per share implies 17.7% upside potential.