Bloom Energy (NYSE: BE) plummeted in pre-market trading after the company reported disappointing Q4 results and a weak outlook. The manufacturer of solid oxide fuel cells used for generating on-site electricity posted revenue of $356.9 million in the fourth quarter, a decline of 22.8% year-over-year, and below consensus estimates of $470.7 million.

The company reported adjusted earnings of $0.07 per share in Q4 as compared to $0.22 per share in the same period last year and again fell short of Street estimates of $0.09 per share. In addition, BE announced the departure of CFO Greg Cameron from the company.

In FY24, Bloom has projected revenues between $1.4 billion and $1.6 billion with adjusted operating income likely to be between $75 million and $100 million. The revenue estimate was below Street forecasts of $1.75 billion.

Is Bloom Energy a Good Buy?

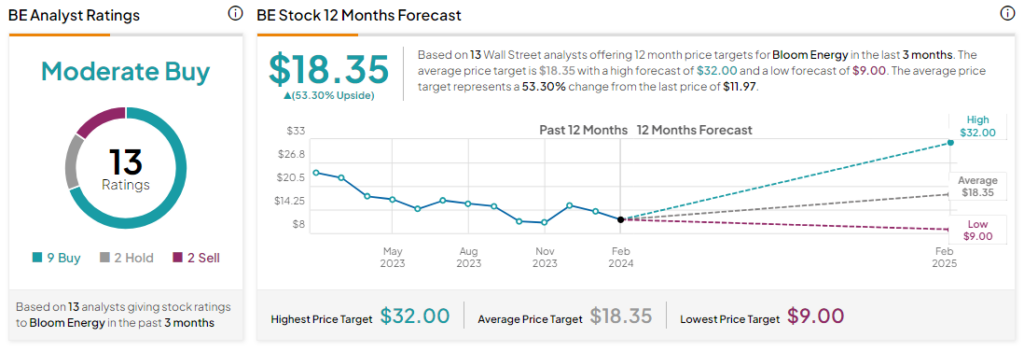

Analysts remain cautiously optimistic about BE stock with a Moderate Buy consensus rating based on nine Buys and two Holds and Sell each. Over the past year, BE has slid by more than 45%, and the average BE price target of $18.35 implies an upside potential of 53.3% at current levels.