Since announcing financial results for Q4 2023, shares of Bloom Energy (NYSE:BE) have accelerated the stock’s cascade downward. BE stock is down -62% over the past year. Investors looking for the clean-energy generator manufacturer to post stronger results were disappointed. News of the CFO’s departure from the company merely added insult to injury. Now they are left with reading tea leaves, and the forecast is mixed.

About Bloom

Bloom Energy Corp. is a San Jose-based company that is focused on green energy alternatives for power generation and manufactures and installs on-site distributed power generators. Bloom Energy’s flagship product, the solid oxide fuel cell power generator, called the Bloom Energy Server, offers cost-effective power solution.

Bloom Energy’s fuel-cell servers, which generate on-site electricity, are gaining traction in areas such as data centers, hospitals, and military facilities. These institutions, particularly those that cannot afford to risk a power outage, benefit from the servers’ ability to provide an independent source of electricity.

Despite its rapid growth, Bloom Energy has historically struggled to turn a profit. Still, data centers, which are known for their high power consumption, could use the micro-grids created by these servers to overcome limitations in mainstream electricity supply, making Bloom Energy’s product an increasingly appealing option.

What’s Impacting BE Stock

Bloom Energy recently reported its financial results for Q4 2023. Revenue fell well below the Street’s expectations, declining 22.8% year-over-year, and EPS of $0.07 per share fell short of consensus estimates of $0.09 per share. Also, Bloom announced that longtime CFO Greg Cameron would be leaving the company.

The disappointing results and news of the CFO’s departure accelerated the downward trend in BE stock, which is down over 42% year-to-date.

Analyst response has been mixed. JPMorgan downgraded Bloom Energy to Hold from Buy with a price target of $14, down from $19. KeyBanc also downgraded Bloom Energy to Sector Weight from Overweight without a price target. Analysts at BofA, Piper Sandler, and Susquehanna all lowered the firm’s price target while keeping the rating they had previously assigned (a Sell, Hold, and Buy respectively).

What is the Forecast for Bloom Energy?

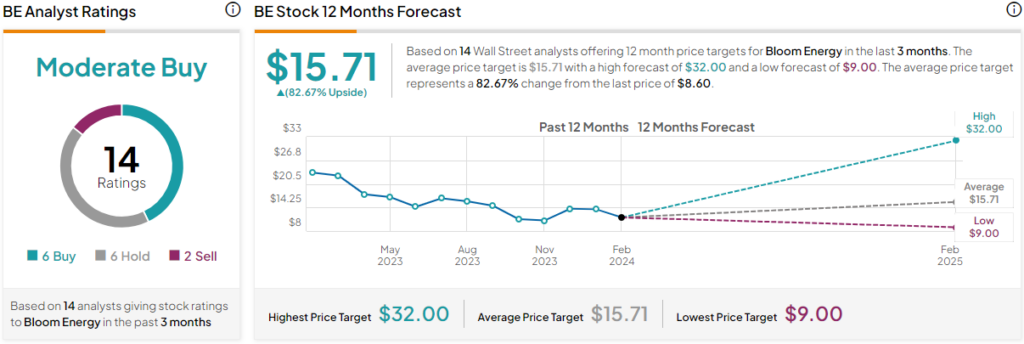

BE is currently rated a Moderate Buy based on the consensus rating from the 14 Wall Street analysts who have offered 12-month price targets for Bloom Energy in the last three months. The average price target is $15.71, with a high forecast of $32.00 and a low forecast of $9.00. The average price target represents an 82.67% upside from the last price of $8.60.

Still, Hope Springs Eternal

Given that Bloom Energy’s technology has the potential to be scaled up and implemented globally, it has the potential to make an impact in reducing greenhouse gas emissions and promoting sustainable development.

Following the recent developments, analysts are mixed on how well Bloom Energy will navigate the ongoing obstacles and continue to grow in the near future.

Shareholders and stakeholders alike remain hopeful.