Wall Street kicked off their coverage of blockchain lender Figure Technology (FIGR) with a bang on Monday, weeks after the company went public to a wide applause. As a result, FIGR stock jumped nearly 5% at the start of regular trading on Monday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Goldman Sachs (GS) and Needham initiated coverage with a Buy rating, while Piper Sandler (PIPR) assigned an Overweight rank, with the trio of Bernstein (AB), Keefe Bruyette (KBW), and Mizuho issuing the Outperform grade. On the other hand, Jefferies (JEF) and the Bank of America (BofA) (BAC) are cautious and debut their ratings with a Hold and Neutral, respectively.

The institutions had the following price targets for the stock, with the stated upsides or downsides when compared to a price of $42.43 per share as of 10 a.m. EDT on Monday.

- Goldman Sachs — $42 (-1.0%)

- Needham — $51 (+20.2%)

- Piper Sandler — $50 (+17.8%)

- Bernstein — $54 (+27.3%)

- Keefe Bruyette — $48.50 (+14.3%)

- Mizuho — $47 (+10.8%)

- Jefferies — $40 (-5.7%)

- Bank of America — $41 (-3.4%)

What Does Figure Do?

Figure operates a blockchain technology that provides home equity line of credit (HELOC) — a type of loan where people the portion of their homes that they actually own, minus mortgage balance, as collateral. Figure raised almost $800 million during its initial public offering (IPO) on Nasdaq in early September.

The company says processing for HELOC lending on its platform takes a little over a week, compared to an average of over one month and a week that traditional banks take. As of early September, Figure had funded more than $16 billion in loans on its blockchain-based system. The company also operates the crypto exchange platform, Figure Markets.

What Are Analysts Saying?

On the Bullish side, Piper Sandler’s five-star analyst Patrick Moley believes that Figure’s shares are trading at a 28% discount compared to its peers. Moley noted that the company offers investors access to “blockchain native disruptors positioned to win in a tokenized economy.”

Similarly, Goldman Sachs views the company as a “unique lender” posed to expand into other consumer loan markets. Moreover, Mizuho believes that Figure is in a position to “increasingly disrupt” the billion-dollar HOLEC market in the U.S, even as it has build a “competitive moat” to ensure its survive.

Still on the positive side, Bernstein pointed out that Figure commands 75% of the tokenized private credit market, even as Keefe Bruyette argues that the crypto firm’s tokenization platform remains set to be a “relative winner in the emerging public blockchain category.”

On the cautious side, BofA highlight several risks for its Neutral rating. One of them is that about 75% of Figure’s future growth is majorly expected to come from one source: Figure connect, the platform through which the company powers HELOC lending. BofA also sees execution risk and a significant weakness in its financial records that could hurt investors’ confidence if left unaddressed.

Similarly, Jefferies believes that FIGR stock is already fairly valued at the current price, despite the “significant opportunity” for growth within Figure’s current product lineup.

What are the Best Crypto Stocks to Buy Now?

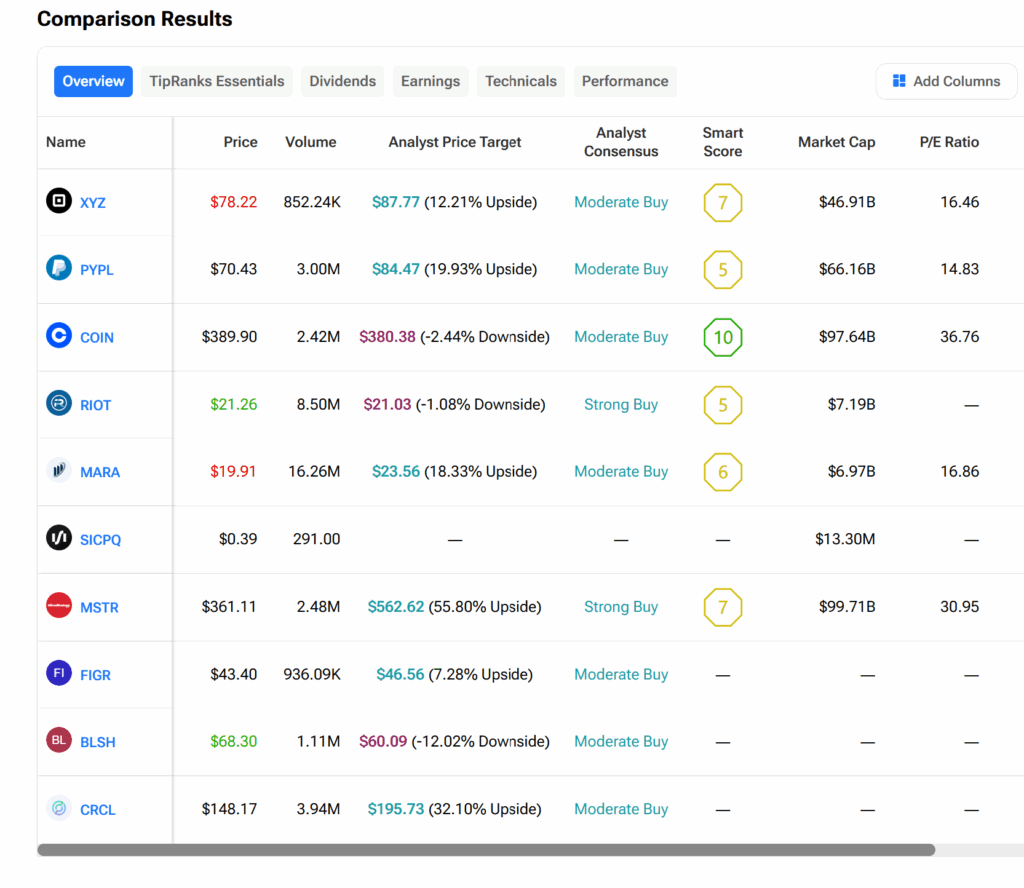

Apart from Figure, other blockchain-related companies such as Gemini, Circle, and Bullish also rode on the IPO hype to go public, raising more funds and, hence, putting the spotlight on crypto stocks. The TipRanks Stock Comparison tool provides insight into which crypto stocks are the best to buy at this moment. Kindly refer to the graphics below.