Wall Street analysts have entered a price-cutting mode on Block’s (XYZ) shares after the fintech and crypto company’s third-quarter earnings results missed the mark on both the top and bottom lines. XYZ shares were down about 15% to $60.40 per share during early trading on Friday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During its third quarter, the American company generated 54 cents per share, well below analysts’ expectations of 64 cents. Its revenue also came in at $6.11 billion, $200 million short of what Wall Street anticipated.

Moreover, the company, which is led by CEO Jack Dorsey, a Twitter (now X) cofounder, expanded its gross profit by 18% year-over-year to $2.66 billion. The growth was driven by its mobile payment platform Cash App’s strong performance in the Buy Now, Pay Later segment.

Analysts Rain Price Cuts on XYZ Stock

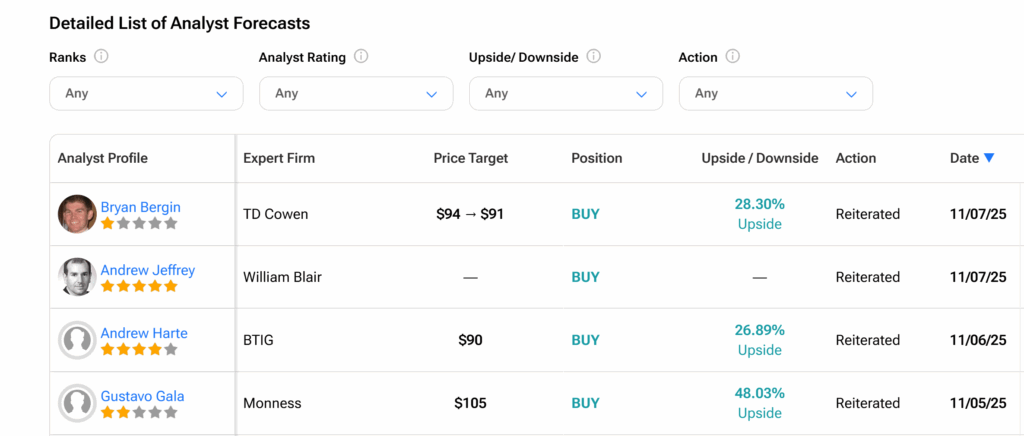

Reacting to the results, Morgan Stanley analyst James Faucette, who trimmed his price target on XYZ stock by 8% to $71, highlighted the performance of Square, Block’s e-commerce payment solutions division.

Faucette noted that Block’s miss on analysts’ forecasts for its earnings before interest, tax, depreciation, and amortization (EBITDA) and the slower growth from Square are “likely disappointing” to investors. The analyst reiterated his Equal Weight (Hold) rating on the company’s shares.

Similarly, Piper Sandler analyst Patrick Moley noted that while Block raised its operating income for the full Fiscal Year 2025, the updated guidance matched the consensus forecast and likely failed to impress investors. Moley trimmed his price target by 5% to $55 per share and maintains his Underweight (Sell) rating on XYZ stock.

However, Keefe Bruyette analyst Vasundhara Govil stuck with his Outperform (Buy) rating despite lowering his price target by a similar percentage to $90. Govil also pointed out that Block missed analysts’ earnings per share estimates and faced higher operating expenses and interest costs that impacted its gross profit.

Is XYZ a Good Stock to Buy?

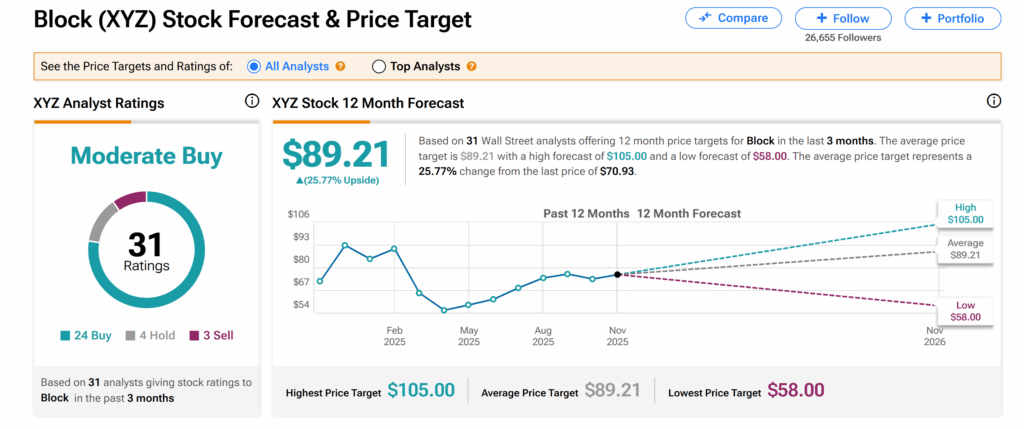

Across the larger Wall Street, Block’s shares currently have a Moderate Buy consensus rating, according to TipRanks. This is based on 24 Buys, four Holds, and three Sells assigned by 31 analysts over the past three months.

At $89.21, the average XYZ price target suggests more than 25% growth potential from the current trading level.