Shares of Block (XYZ) are down 13% after the financial technology and cryptocurrency company reported quarterly results that missed Wall Street’s forecasts across the board.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company run by CEO Jack Dorsey announced earnings per share (EPS) of $0.54, which was well below the $0.64 expected among analysts. Revenue for the year’s third quarter of $6.11 billion was short of the $6.31 billion forecast on Wall Street.

The company known for its popular Cash App blamed the poor results on increased expenses during the quarter. Operating expenses of $2.20 billion were larger than the consensus forecast of $1.91 billion. Management stressed that gross payment volume of $69.3 billion beat the consensus estimate of $68.6 billion, and gross profit of $2.66 billion exceeded forecasts of $2.60 billion.

Block’s income statement. Source: The Fly

Outlook

Looking ahead, management said that they expect a gross profit in the current fourth quarter of $2.755 billion. That’s ahead of the $2.74 billion anticipated among analysts. The company’s full-year operating margin is expected to be 20%.

While Block is increasingly focused on blockchain technologies and crypto, the company still gets the majority of its revenue from its Cash App. That payments app generated a profit of $1.62 billion for Block during Q3, up 24% year-over-year. The Cash App business saw strong growth in the Buy Now, Pay Later space, said management.

Is XYZ Stock a Buy?

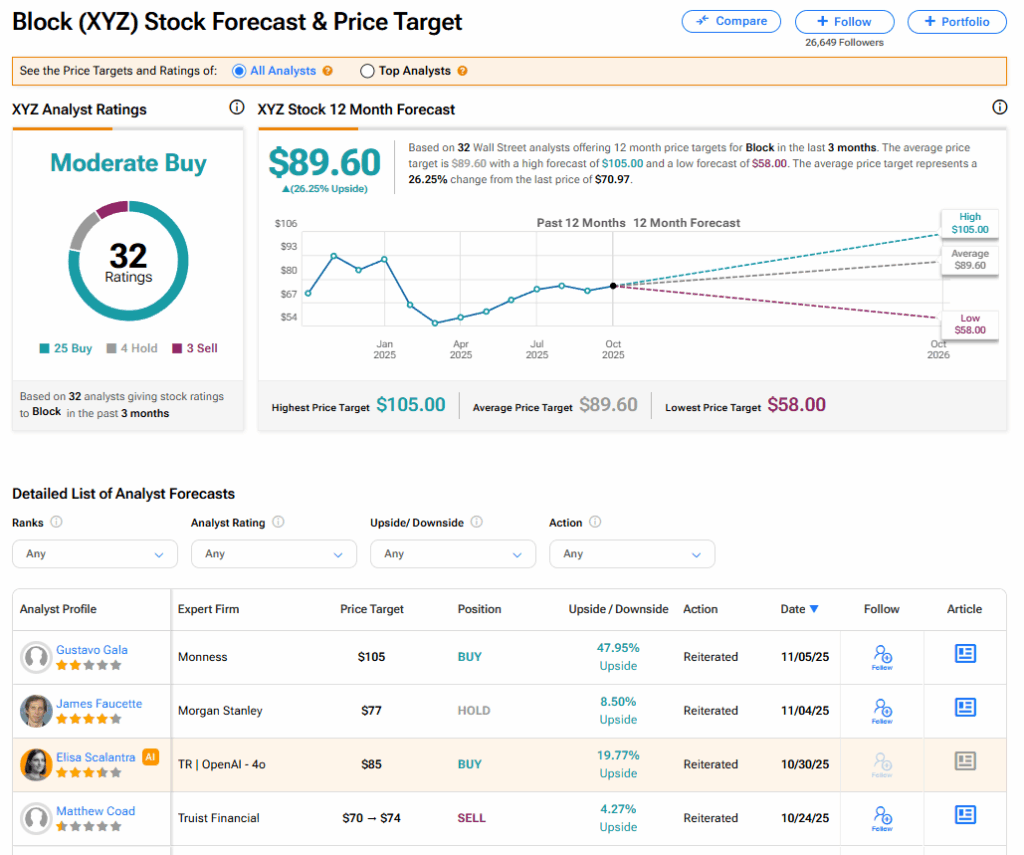

The stock of Block has a consensus Moderate Buy rating among 32 Wall Street analysts. That rating is based on 25 Buy, four Hold, and three Sell recommendations issued in the last three months. The average XYZ price target of $89.60 implies 26.25% upside from current levels. These ratings could change after the company’s financial results.