Alternative asset management company Blackstone (NYSE:BX) has been in the news since it announced that it has limited the redemptions from BREIT, a non-traded real estate income trust (REIT). At the Goldman Sachs U.S. Financial Services Conference held on December 7, Blackstone’s CEO Steve Schwarzman explained that the redemptions from the $69 billion BREIT were due to investors impacted by market volatility and not because of dissatisfaction with the fund’s performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BX stock has declined nearly 14% since the company made the announcement about the limitations on BREIT redemptions. Blackstone limited the withdrawals from BREIT as redemption requests exceeded the monthly limit of 2% of its net asset value and the quarterly limit of 5%. The announcement triggered fears about the future of the fund.

Schwarzman called BREIT “some of our best work” and stated that he found the concerns about the fund a “bit baffling.” He stated that most of the redemption requests were from Asian investors, who were particularly hit by the steep decline in the Hang Sang Index. The CEO noted that Asian investors, who often use borrowed funds to back their positions, were looking for liquidity to meet margin calls when markets tanked.

REITs backed by other asset managers, including Starwood, Ares Management Corp (ARES), KKR & Co Inc, and Brookfield (BAM), also witnessed a rise in redemption requests in the first three quarters of this year, per Reuters, which cited real estate-focused advisory firm Robert A. Stanger & Company, Inc.

Highlighting the fund’s performance, Schwarzman stated that BREIT’s returns have averaged 13% a year for the last six years and are three times the return of the REIT index.

Is Blackstone a Buy or Sell?

Following the announcement about the limits on the redemptions from BREIT, Barclays analyst Benjamin Budish downgraded Blackstone to a Hold from Buy and lowered his price target to $90 from $98.

Budish stated, “While we remain optimistic on the longer-term retail opportunity for alts — and on the rest of Blackstone’s business in general, which we very much view as best-in-class — we think the retail headwind is likely to remain an overhang on the stock for some time.”

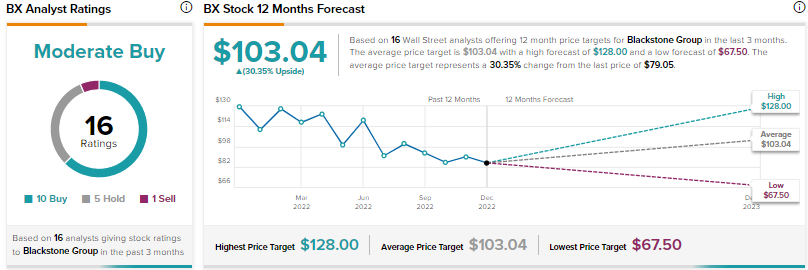

Wall Street is cautiously optimistic about Blackstone stock, with a Moderate Buy consensus rating based on 10 Buys, five Holds, and one Sell. The average BX stock price target of $103.04 implies 30.4% upside potential. Shares have plunged 39% year-to-date.