BlackBerry (TSE: BB), a provider of intelligent security software and services to businesses and governments, will report its Q3 earnings on December 21 after markets close.

Stock Performance

Year-to-date, the stock has gained approximately 35% and is currently trading over C$11.30. Strong earnings could boost BB shares, so let’s have a look at what analysts are expecting.

Analyst Estimates

Analysts on average expect BlackBerry to post a loss of $0.07 per share in Q3 2022, compared to EPS of $0.02 in Q3 2021. The estimated revenue is $176.58 million, representing a decrease of nearly 27% from the prior-year quarter.

BlackBerry beat earnings estimates in the past eight quarters and upcoming earnings might beat estimates.

Points to Watch

During the quarter, BlackBerry partnered with Deloitte to help OEMs and those building mission-critical applications secure their software supply chains.

BlackBerry improved the integration of BlackBerry Unified Endpoint Manager (UEM) and Microsoft 365 so that businesses can benefit from BlackBerry’s leadership in security while using Microsoft (MSFT) products.

BlackBerry QNX is the market leader in certified automotive security embedded software. The technology is in production programs with 45 original equipment manufacturers, and the software is embedded in more than 195 million vehicles worldwide.

BlackBerry was selected by Mahindra & Mahindra, a leading automotive company in India, to power a cockpit domain controller.

These developments are likely to have positively impacted BlackBerry’s revenue during the quarter.

Wall Street’s Take

Last week, TD Securities analyst Daniel Chan kept a Sell rating on BB with a $9.00 (C$11.61) price target. This implies 0.8% upside potential.

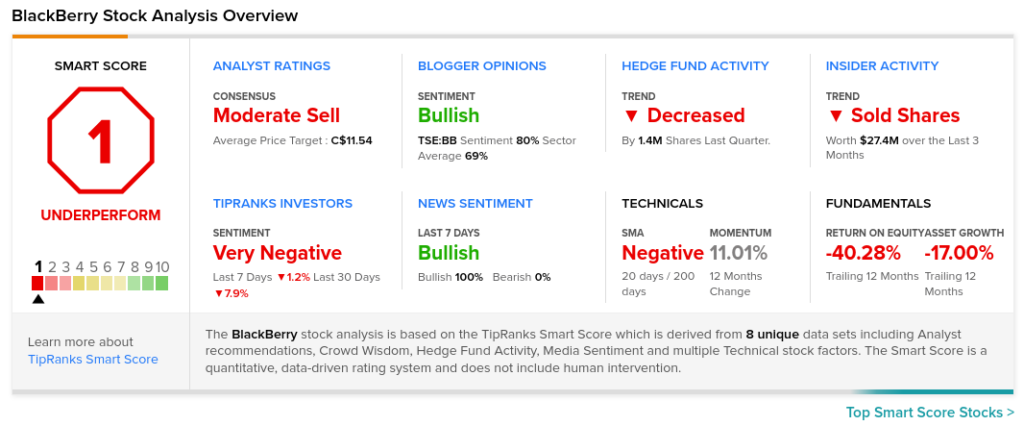

Overall, BB scores a Moderate Sell rating among Wall Street analysts based on one Hold and three Sells. The average BlackBerry price target of C$11.54 implies 0.2% upside potential to current levels.

TipRanks’ Smart Score

BB scores a 1 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to underperform the overall market.

Related News:

Enghouse Systems Q4 Revenue Decreases 6.5%