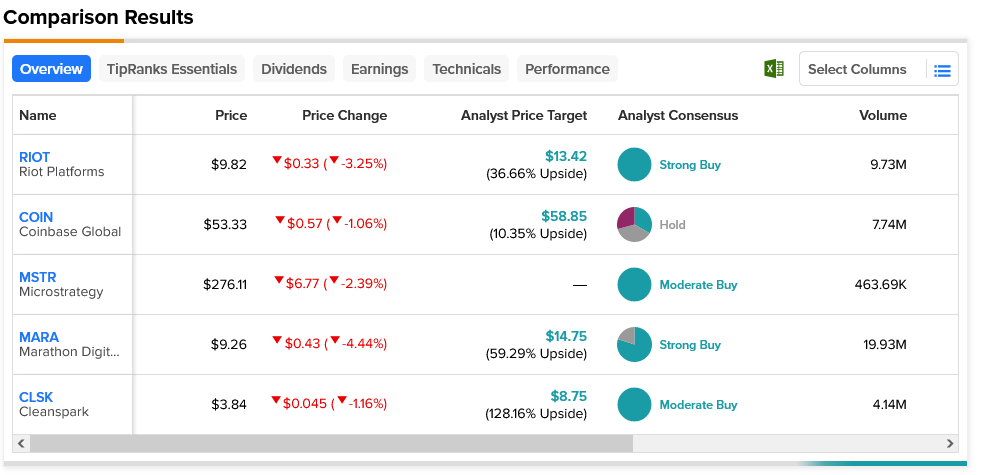

For a while there, it was beginning to look like Bitcoin (BTC-USD) was going to recover. Today turned that assumption on its ear, and Bitcoin plunged all the way to a low it hasn’t seen in three months. Several crypto stocks, ranging from Riot Platforms (NASDAQ:RIOT) and Coinbase (NASDAQ:COIN) to more tangentially connected stocks like Microstrategy (NASDAQ:MSTR), Marathon Digital (NASDAQ:MARA) and Cleanspark (NASDAQ:CLSK) all slid lower in Thursday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Essentially, the biggest hit to Bitcoin today was the Federal Reserve’s decision to halt its interest rate hikes for a month. The plan was to take a step back from frantic rate hiking to see if the rate hikes were actually having an impact. But the move didn’t help alternative investments much, and Bitcoin is one of the most alternative investments around. A senior technical analyst with StockCharts.com, Julius de Kempenaer, noted that the $25,000 level is a major support level for Bitcoin; if it can’t hold the line above $25,000 for a while, then it’s likely to keep sliding from here.

While retail investors alone seem to be having trouble keeping Bitcoin above that key support level, there are some signs institutional investors may be ready to weigh in. BlackRock (NYSE:BCAT), the largest asset manager in the world, is poised to bring in an application for a Bitcoin exchange-traded fund (ETF). BlackRock has already turned to Coinbase Custody for support on this point, and should BlackRock get behind crypto, it could be good news for the whole paradigm.

That’s not going to help anyone today, though; Marathon Digital took the biggest hit so far today, down 4.44% at one point. However, it’s also considered a Strong Buy with the second-highest upside potential among the five aforementioned stocks. Its average price target of $14.75 implies 59.29% upside potential. Meanwhile, Coinbase, who took the lightest hit, is only considered a Hold by analyst consensus. Further, its average price target of $58.85 gives it merely 10.35% upside potential.