The Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has recommended Biohaven Pharmaceutical Holding Company Ltd.’s (NYSE: BHVN) and Pfizer Inc.’s (PFE) calcitonin gene-related peptide (CGRP) receptor antagonist, rimegepant, for marketing authorization.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 75 mg dose of rimegepant, which is available as an orally dissolving tablet, is recommended for both the acute treatment of migraine with or without aura in adults, as well as for the preventive treatment of episodic migraine in adults who have gone through a minimum of four migraine attacks monthly.

The European Commission (EC) will now verify the CHMP’s opinion, whose European Union (EU) trade name will be VYDURA. If approved, the drug will be valid in all 27 EU member states, along with Iceland, Lichtenstein, and Norway. Remarkably, on approval, rimegepant will be the first-of-its-kind oral CGRP receptor antagonist in the EU, recommended for both acute and preventive migraine medication.

Shares of Biohaven closed 8.9% lower on Friday at $121.94.

Supporting Data

The CHMP positive opinion followed the results from three Phase 3 studies and a safety study in the acute treatment of migraine, along with a Phase 3 study with a one-year open-label extension in the preventive treatment of migraine. In these studies, rimegepant demonstrated a well-tolerated safety profile.

As per the terms of the commercialization agreement inked earlier this year, Pfizer has the right to commercialize rimegepant outside the U.S.

Official Comments

The Global President at Pfizer Internal Medicine, Nick Lagunowich, commented, “This expression of confidence in rimegepant brings us closer to our goal of helping patients suffering from this debilitating neurological disease find appropriate treatment. Pfizer is proud to have a strong footprint in Europe, which will help bring this important potential new treatment option to millions of adults in Europe living with migraine.”

Licensing Agreement with Bristol Myers Squibb

In a separate release, Biohaven announced that it has inked a worldwide license agreement with Bristol Myers Squibb (NYSE: BMY) for the development and commercialization rights to taldefgrobep, a muscle-targeted experimental treatment designed for neuromuscular disease.

Biohaven CEO Vlad Coric said, “We are extremely excited about the potential for taldefgrobep to improve the lives of patients and families affected by neuromuscular diseases. We believe the development of innovative anti-myostatin therapies designed to enhance muscle mass and strength may represent the next frontier of neuromuscular treatments and will build on the tremendous progress made by existing motor neuron-targeted therapies.”

Earnings

Biohaven reported a loss of $2.32 per share in the fourth quarter of 2021, above the Street’s estimated loss of $2.10 per share. Meanwhile, revenue for the quarter stood at $190 million, topping the consensus estimate of $169.78 million.

Research and Development (R&D) expenses were $91.1 million, up 23.5% year-over-year, while Selling, General, and Administrative (SG&A) expenses grew 79.3% to $219.5 million.

Analyst’s Recommendation

Following the earnings results, William Blair analyst Tim Lugo reiterated a Buy rating on Biohaven.

Lugo said, “We view Nurtec ODT as the leader in acute migraine and believe the approval for the preventive treatment of episodic migraine in mid-2021 will solidify the product’s position as the leading innovative therapy for migraine.”

Shares of Biohaven have rallied almost 42% over the past year, while the stock still scores a Strong Buy consensus rating, based on 7 Buys versus 1 Hold. That’s alongside an average Biohaven price target of $158.43, which implies 29.9% upside potential to current levels.

Risk Analysis

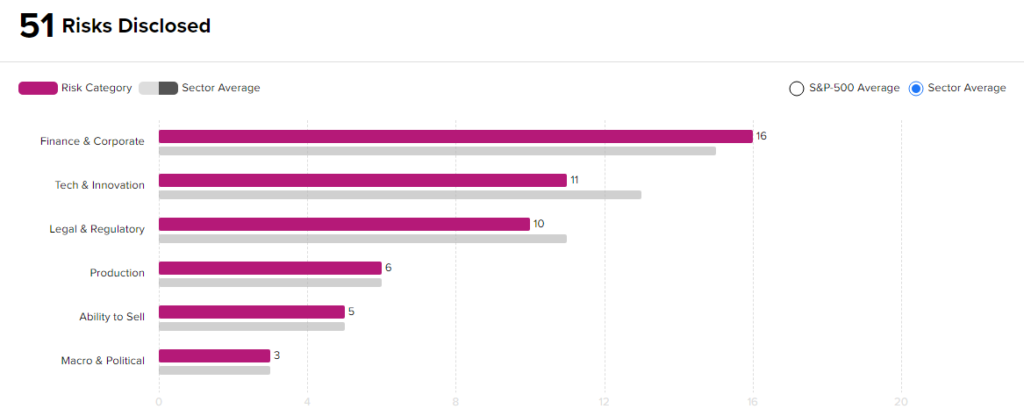

According to the new TipRanks Risk Factors tool, Biohaven stock is at risk mainly from three factors: Finance & Corporate, Tech and Innovation, and Legal & Regulatory, which contribute 16, 11, and 10 risks, respectively, to the total 51 risks identified for the stock.

Though Biohaven is at a higher risk from a financial standpoint than other companies in its industry, it remains less risky from a technical and a legal standpoint. Given its risk profile and current stock movements, investors might consider investing in this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Coinbase Falls 5.8% Despite Strong Q4 Earnings

Zscaler Plunges 15% Despite Q2 Beat

Moderna Soars 15% on Stellar Q4 Results