Changpeng Zhao-led crypto exchange Binance is making efforts to pacify investors and avoid a run on its withdrawals, akin to the recent FTX debacle. The company has hired global accounting firm Mazars to “audit” and release certain numbers, hoping to calm investors’ anxiety. However, the five-page document released recently offers limited information and does little to earn back investors’ trust.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Binance calls the statement a “proof of reserve report” and stated, “this means that we are showing evidence and proof that Binance has funds that cover all of our user’s assets 1:1, as well as some reserves.” Interestingly, even though the names state assets and liabilities, these figures only refer to Binance’s Bitcoin (BTC-USD) holdings. So, it is questionable whether the corporation is trying to pacify or mislead investors.

The document only shows three numbers namely, “customer liability report balance,” standing at 597,602 bitcoins, “asset balance report,” standing at 582,486 bitcoins, and “net liability balance (excluding in-scope assets lent to customers),” showing a liability figure of 575,742 bitcoins.

The report in itself is also confusing, as the liability figure is 3% higher than the asset figure, implying a shortfall and failure to meet the claimed 1:1 ratio of reserves to assets. However, Binance claims that it allows customers to borrow crypto assets through loans and that the last figure of “net liability balance” was adjusted for the loans and thus showed a 101% collateralized status.

Commenting on the report, Binance’s chief strategy officer, Patrick Hillmann, said that the report did not cover the financial condition of the company’s U.S. operations either and that “This is the first step in what’s going to be a much longer process.”

Binance also has holdings in other cryptocurrencies that have not been disclosed in Mazars’ report. Notably, Binance also created an “emergency insurance fund” in 2018, which could be sourced in case of a default or shortfall in Binance’s finances. The company claims to have restored the fund balance to $1 billion.

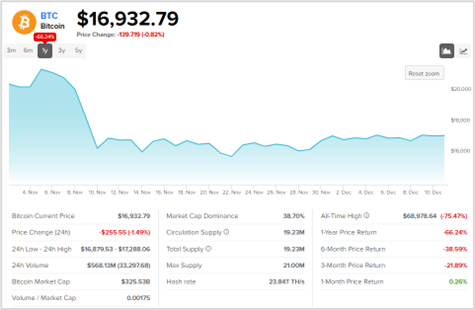

Meanwhile, Bitcoin is trying to hold over the $17,000 mark lately after falling to historic lows following the crypto contagion. BTC is still trading at a 75.5% discount to its all-time high of $68,978.64 marked on November 10, 2021.