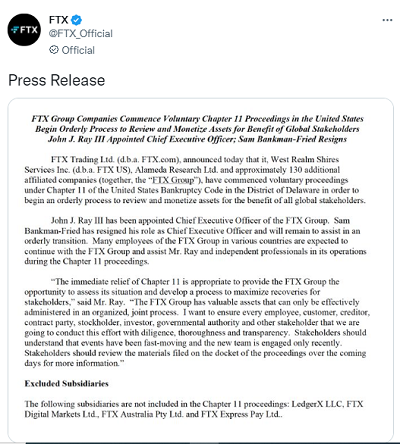

On Friday, FTX stated in a press release that the crypto exchange, along with Alameda Research and around 130 companies affiliated with the FTX Group have filed for bankruptcy “in order to begin an orderly process to review and monetize assets for the benefit of all global stakeholders.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

FTX also stated that Sam Bankman-Fried will step down as CEO and John J. Ray III has been appointed as the new CEO.

Ray stated, “The immediate relief of Chapter 11 is appropriate to provide the FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders.”

The FTX collapse was imminent after the Securities Commission of the Bahamas froze its assets and Binance decided to withdraw its non-binding offer to buy FTX.

Moreover, to add to FTX’s woes, a Wall Street Journal report on Thursday stated that FTX’s sister company, Alameda Research, owed FTX $10 billion.

The FTX saga has also affected other crypto stocks and cryptocurrencies.

The two major cryptocurrencies, Bitcoin (BTC-USD) and Ethereum (ETH-USD) are down by around 19% and 20%, respectively in the last five days alone. Over the last year, both of these cryptocurrencies have lost more than 70% in value.

Crypto Stocks Under Pressure Following FTX Collapse

Shares of MicroStrategy (NASDAQ: MSTR) have tumbled more than 35% in the past five days as the price of bitcoin plummeted. The mobility software company is also heavily invested in bitcoin and holds it as a treasury reserve.

Earlier this month, the company stated that it had total holdings of 130,000 bitcoin with a carrying value of $1.99 billion.

The company’s management stated on its Q3 earnings call, “During the quarter, Bitcoin prices remained above our carrying value, low watermark of approximately $17,600 – and as a result, we saw a minimal digital asset impairment charge in Q3. “

Considering this low watermark, there is a possibility that MSTR will record a digital asset impairment charge in Q4 as currently, Bitcoin prices are below that watermark.

The FTX collapse prompted MicroStrategy’s Founder and Executive Chairman, Michael Saylor to comment in an interview with CNBC, “We saw what can go wrong if a centralized token, trading on an unregistered exchange, blows up this week. I think the bitcoiners have been predicting this for a long time. Speaking for all the bitcoiners, we feel like we are trapped in a dysfunctional relationship with crypto and we want out.”

Shares of crypto exchanges Coinbase Global (NASDAQ: COIN) and Robinhood Markets (NASDAQ: HOOD) have also dropped by around 13% and 23% over the past five days amid the FTX collapse.

Coinbase CFO Alesia Haas told Bloomberg regarding the FTX fiasco, “We’re going to see definite lower volumes because people are going to hold back at this moment in time.”

Here is more from the world of cryptocurrencies.