Binance just filed a fiery motion to dismiss a $1.76 billion lawsuit brought by FTX, slamming it as an attempt to rewrite history. The lawsuit accuses Binance and its former CEO Changpeng Zhao (CZ) of playing a key role in FTX’s collapse. But Binance isn’t having it.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

In a May 16 filing in Delaware Bankruptcy Court, Binance’s legal team called the suit “legally deficient.” Their argument? FTX didn’t implode because of market sabotage — it fell apart under the weight of its own fraud.

“Plaintiffs are pretending that FTX did not collapse as the result of one of the most massive corporate frauds in history,” the filing states, directly referencing Sam Bankman-Fried’s conviction on seven felony counts.

Binance Says CZ’s Tweet Was Based on Public Info

FTX’s estate claims Zhao’s November 2022 tweet about liquidating FTT tokens set off a panic and triggered the crash. Binance says that’s revisionist history. The decision to exit was based on a CoinDesk report days earlier, which exposed Alameda’s shaky balance sheet.

“There are no facts showing Binance acted maliciously,” the motion argues. The company also says Zhao’s claim about minimizing market impact was a fair one — and not proof of bad faith.

Binance Fights U.S. Jurisdiction over the Case

Another key defense? Binance says none of the entities named are based in the U.S., meaning the Delaware court doesn’t have jurisdiction. The complaint, according to Binance, relies on “pure conjecture,” much of it drawn from “a convicted fraudster’s hindsight speculation.”

Meanwhile, FTX is preparing to repay $5 billion to creditors starting May 30, as part of its reorganization plan. Some parties could recover as much as 120% of their claims, depending on eligibility and class.

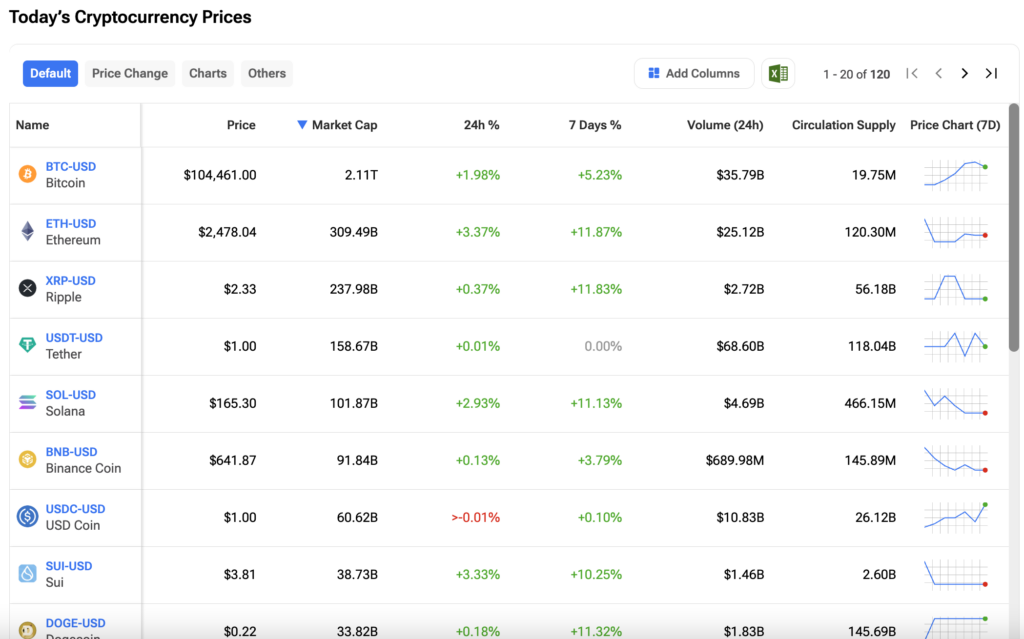

Legal showdowns like this can rattle sentiment, trigger sell-offs, and even mark the end of short-term crypto bull runs. Investors can track how lawsuits, liquidations, and market panic ripple through the system using the TipRanks Cryptocurrency Center—featuring real-time prices, technical analysis, and comparison tools.