Ken Griffin comes out on top again. For the second consecutive year, his Citadel fund has claimed its position as the leading hedge fund powerhouse, according to the latest annual chart of the top 20 money managers compiled by LCH Investments. Citadel generated returns of $8.1 billion for its investors in 2023, bringing its total earnings since its establishment in 1990 to $74 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So, it’s been a fruitful year for the billionaire. The good news, according to Griffin, is that looking at the big economic picture, 2024 seems promising as well. “The overall economy looks pretty damn good right now,” Griffin recently said. “This is a real change in mindset from where we were September, October last year.”

Griffin thinks a “soft landing” is plausible this year, supported by recent data showing a robust labor market, robust GDP growth, and inflation cooling at a more favorable pace than initially anticipated.

Meanwhile, Griffin has been loading up on the names he sees as poised to deliver the goods in 2024. For someone who won in the market last year, it’s rather fitting that two of his recent purchases were also big gainers – chip giants Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD).

Griffin evidently anticipates further gains and it appears he’s not alone in this belief. According to the TipRanks database, both of these stocks are rated as Strong Buys by the analyst consensus. So, let’s see what all the fuss is about.

Nvidia

Last year’s bull market was all about tech, or more specifically, tech companies with big exposure to the year’s main theme – AI. There’s hardly a name that better encapsulates this rising trend than Nvidia. The reason for that is a rather simple one. The semi-giant has cornered the market for the chips that power the AI tech, with its best-in-class offerings commanding a market share of over 85% in generative AI accelerator chips.

The company’s positioning in the AI market was rewarded by investors, who sent shares up by 239% last year. But while plenty of tech stocks enjoyed 2023’s AI rally by dint of association, Nvidia’s gains were built entirely on real-world success, with the company delivering a series of earnings reports that stunned Wall Street.

A look at the latest set of results paints the picture. In the company’s fiscal third quarter (October quarter), driven by Data Center revenue climbing 279% year-over-year to a record $14.51 billion, total revenue clocked in at $18.12 billion, amounting to a 205.6% y/y increase. The figure also came in ahead of the Street’s forecast by $2.01 billion. At the opposite end of the equation, adj. EPS of $4.02 trumped analyst expectations by $0.63.

The outlook was just as strong. For the upcoming FQ4 print, Nvidia is calling for revenues of $20 billion, plus or minus 2%, implying y/y growth of nearly 231% and some distance ahead of consensus at $17.82 billion.

Griffin must also see more good times ahead. His Citadel Advisors fund purchased 1,579,153 NVDA shares in Q4, representing a 77% increase in the fund’s holdings and bringing its total stake to 3,633,025 shares. These are currently worth more than $2.68 billion.

That confidence is mirrored by UBS analyst Timothy Arcuri’s take. “We substantially raise our estimates and price target to $850 ahead of NVDA’s FQ4:24 (Jan) earnings report,” the 5-star analyst, who ranks in 7th spot amongst Wall Street’s stock experts, recently said.

“Customer discussions confirm NVDA’s lead times have come in substantially over the past few months (now ~3-4 mos), meaning shipment slots are still available in C2H:24. Normally, this is bad, but demand for AI compute capacity is still so strong, in the near term, we think this just points to significant upside potential to shipments/revenue, such that we think NVDA beats on data center by ~$2.5-3B (i.e. FQ4:24 Jan Q UBSe Data Center revenue of $19.5B versus Street $16.8B, and total revenue ~$23B versus Street ~$20.2B). Given supply chain work, we see enough capacity for NVDA to guide $25-26B on total revenue,” Arcuri added.

Arcuri has a Buy rating on NVDA stock, while the aforementioned $850 price target suggests the shares have room for further growth of ~16% over the next year. (To watch Arcuri’s track record, click here)

Nvidia has solid support amongst Arcuri’s colleagues, but its current valuation presents a conundrum. NVDA’s Strong Buy consensus rating is based on 34 Buys and 4 Sell. However, the share gains keep coming in thick and fast, and the $703.30 average price target now suggests shares will decline by 4% over the next 12 months. It will be interesting to see whether other analysts follow in Arcuri’s footsteps and raise their price targets shortly. (See Nvidia stock forecast)

AMD

Up next, AMD. But before we get the lowdown on Griffin’s next big purchase, here’s a fun fact: Nvidia CEO Jensen Huang and AMD CEO Lisa Su are first cousins once removed. It’s tempting to imagine a family gathering with Su warning Huang that he better watch his back as its chip rival is coming to challenge its status as the undisputed AI chip leader.

That would not be some empty claim as AMD has already disrupted the hegemony of another chip giant. Intel used to rule over the CPU space, before the Su-guided AMD steadily ate away at its dominance in the field. Therefore, AMD is naturally seen as a company that could give Nvidia a run for its money in the AI chip game.

That must inform part of Griffin’s decision to up his AMD stake considerably in Q4. He increased his Citadel Advisors fund’s holdings by 140% with the purchase of 506,881 shares. The fund’s total amount now stands at 6,005,863 shares, which command a market value of more than $1.07 billion.

Like Nvidia, AMD stock has been piling on the gains while generally impressing in its quarterly readouts. The latest print, for 4Q23, saw revenue rise by 10.7% year-over-year to $6.2 billion, beating the analysts’ forecast by $60 million. Adj. EPS of $0.77 met Street expectations. On a sour note, the semi company’s revenue guide for Q1 came in a tad below expectations although the firm increased its 2024 Data Center GPU revenue forecast, from $2 billion+ beforehand to ~$3.5 billion.

AMD believes its new AI chips are going to help take away market share from Nvidia, and that view gets the support of Rosenblatt’s Hans Mosesmann, also an analyst ranked in the top 10 of Street experts.

“AMD’s execution has been flawless in the areas that matter for investors: DC CPU, client CPU, and new AI acceleration roadmap that we see capturing double-digit share by 2025,” the 5-star analyst explained. “As the AI dynamic moves more and more to the ‘edge’, AMD’s existing presence in the market, the range of CPU/GPU/DPU/FPGA products, and disruptive ‘chiplet’ expertise are set to make AMD a true secular idea.”

These comments underpin Mosesmann’s Buy rating, while his $250 price target factors in 12-month returns of 40%. (To watch Mosesmann’s track record, click here)

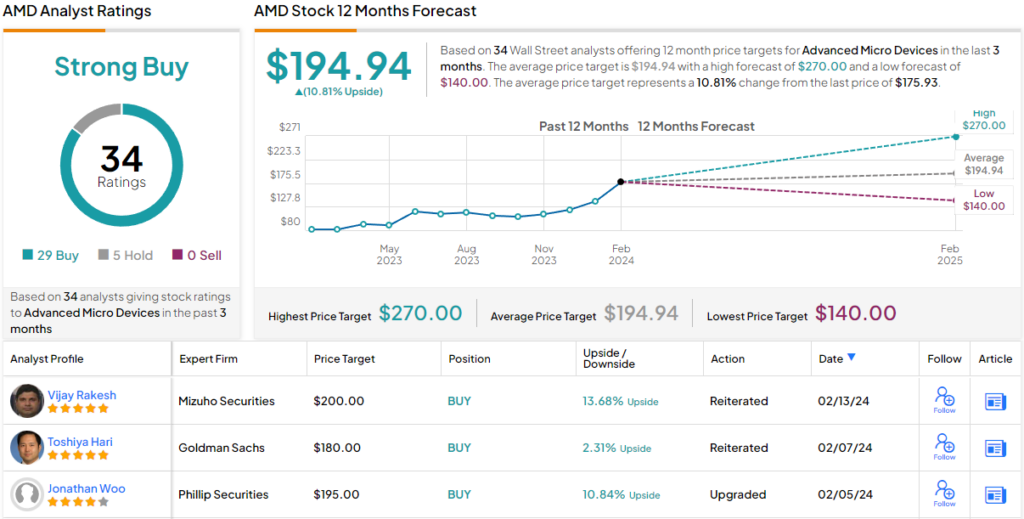

Most analysts agree here with Mosesmann. AMD stock claims a Strong Buy consensus rating, based on a mix of 29 Buys and 5 Holds. The average target currently stands at $194.94, implying shares will appreciate by 9% over the next year. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.