BigBear.ai Holdings (BBAI) stock has jumped nearly 350% over the past year and is up about 62% so far in 2025, driven by optimism around its expanding role in artificial intelligence (AI) and government analytics. Recent wins, including a five-year NSA contract, have boosted interest in the stock. However, weak financials remain a concern. Q2 revenue fell to $32.5 million, and analysts see limited upside ahead, implying a 19% downside from current levels. Still, with $390 million in cash and strong defense ties, BigBear.ai has the resources to invest further in growth and strengthen its position in the AI sector.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors Remain Divided on the Stock’s Outlook

Opinions on BigBear.ai’s outlook remain mixed. Recently, top investor Rick Orford said the company isn’t built on hype but on “real systems governments and airports depend on.” He believes its Veriscan product and government contracts add credibility and long-term promise, even if a near-term move to $10 or $15 per share seems “unlikely.”

Meanwhile, investor Adam Spatacco said that while BigBear.ai operates in a promising niche, the company still needs to build scale and secure more large, long-term contracts to match investor expectations. He said BigBear.ai’s rise shows AI hype more than solid results, and future growth will hinge on steady execution and a wider customer base.

With the stock already up sharply this year, analysts say BigBear.ai must now prove it can deliver steady revenue growth and improve margins to sustain investor confidence.

Is BBAI a Good Stock to Buy?

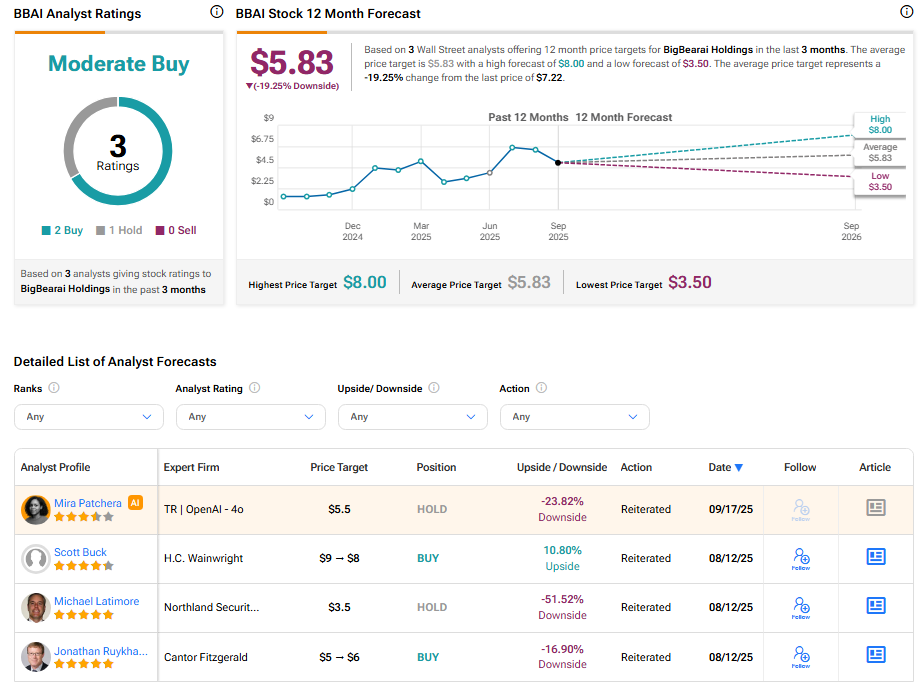

Currently, Wall Street has a Moderate Buy consensus rating on BigBear.ai Holdings stock based on two Buys and one Hold. The average BBAI stock price target of $5.83 indicates about 19% downside risk from current levels.