There’s no arguing with the stellar returns BigBear.ai (NYSE:BBAI) stock has enjoyed during the past year. Indeed, the big data analytics company’s share price has gained some 382% over the past 12 months, riding the powerful wave of investor enthusiasm surrounding AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That doesn’t mean that 2025 has been smooth sailing throughout, however. BBAI has yet to regain its February heights, as major losses in Q4 2024 earnings ($108 million verses expectations in the low double digits), high valuations (its price-to-sales valuations differ by triple-digit percentages from the sector average), and competition with the world-conquering Palantir have all pressured its share price.

Still, for the most part, the company has been bounding back upwards. In fact, BBAI now stands to benefit from various pieces of the One Big Beautiful Bill, such as the billions that have been allocated to improve border screening technologies.

Against this backdrop, top investor Rick Orford sees BigBear.ai as a company with real staying power. While he doesn’t expect the stock to hit $10 or $15 over the next year, he also doesn’t view it as a “flashy AI play” lacking substance.

“BigBear isn’t built on hype. It’s already built into critical systems. They are in fact already embedded in systems that governments and airports depend on as their technology supports critical missions in national security, defense, and other high stakes industries,” explains the 5-star investor, who is among the top 1% of stock pros covered by TipRanks.

Orford notes that the company’s technology has gained a foothold in areas where precision and dependability is simply non-negotiable. The company’s contracts with government bodies such as the Pentagon and the National Security Agency are more than “just revenue, that’s credibility.”

The investor is particularly bullish regarding BBAI’s Veriscan product, which is geared to support ports of transit deploy secure and efficient identification processes. There’s a real possibility that BigBear could capture a major portion of the global logistics security market, which could certainly boost its share price.

“You could say that BigBear is taking defense level tech and pushing it into the mainstream,” adds Orford, who points out that BBAI’s facial recognition technology has achieved 99% real-time matching.

This places BBAI at an interesting inflection point, the investor further explains, as the company’s move into finance and consumer applications could open a spigot of commercial opportunities going forward.

All that being said, Orford isn’t quite willing to bet the farm just yet on this “high risk, high reward” stock. Instead, he’s planning on sitting this one out in favor of other opportunities with “verifiable revenue growth.” (To watch Rick Orford’s track record, click here)

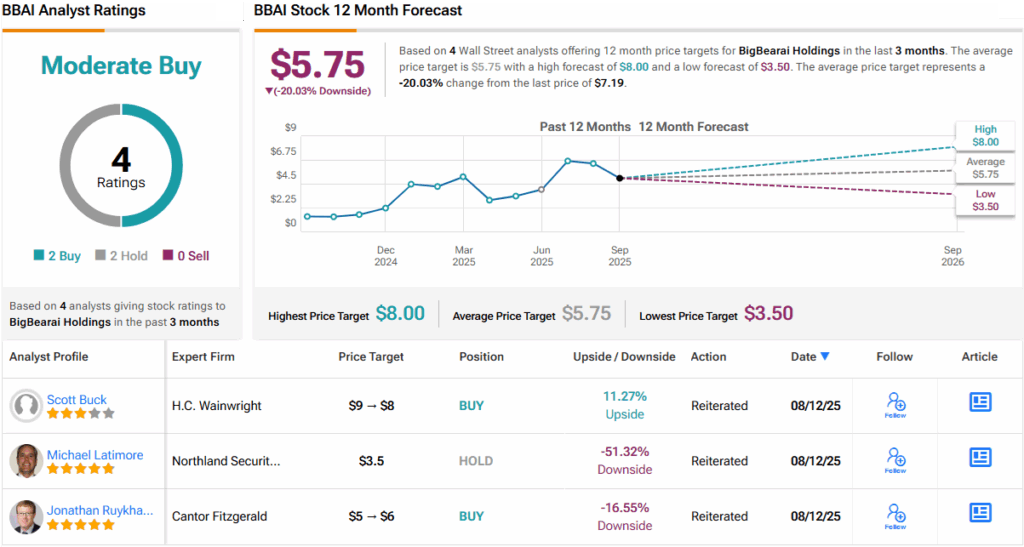

The lightly covered stock hasn’t exactly set Wall Street on fire. With 2 Buys and 1 Hold, BBAI carries a Moderate Buy consensus rating. Its 12-month average price target of $5.75 would translate into losses approaching 20%. (See BBAI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.