Discount retailer Big Lots (NYSE:BIG) reported a third-quarter adjusted loss of $4.83 per share compared to an adjusted loss of $2.99 per share in the same period last year. This was worse than analysts’ expectations of a $4.68 per share loss.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Even the company’s net sales declined by 14.7% year-over-year to $1.03 billion in the third quarter, in line with consensus estimates.

Bruce Thorn, President and CEO of Big Lots, commented, “Although the environment remains challenging, we continued to make significant progress in turning around our business.” The company’s management added that its cost savings plan, Project Springboard, will likely deliver $100 million in SG&A (sales, general, and administrative) cost savings in FY23.

The project is “off to a strong start and on track to deliver $200 million of bottom-line benefits, spanning gross margin and SG&A, of which we expect a high proportion to be realized on a run-rate basis by the end of 2024.”

Looking forward to the fourth quarter, the company expects comparable sales to “improve relative to the third quarter and be in the high-single-digit negative range, as key actions to improve the business continue to gain traction.”

Is Big Lots a Good Stock to Buy?

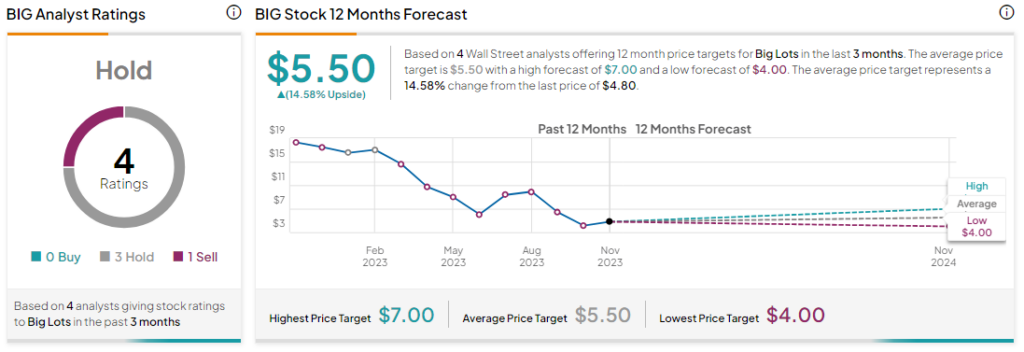

Analysts remain neutral on BIG stock, with a Hold consensus rating based on three Holds and one Sell. Year-to-date, its shares have slid by more than 60%, and the average BIG price target of $5.50 implies an upside potential of 14.6% from current levels.