Shares of Beyond Meat (NASDAQ:BYND) plunged nearly 12% in extended trading yesterday after the company missed sales estimates in its second-quarter results. The plant-based meat producer also slashed the outlook for full-year Fiscal 2023 sales owing to declining demand for its products. Even so, BYND stock has gained 23.4% so far this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Details of Q2FY23 Results

Net revenues for the quarter fell 30.5% year-over-year to $102.1 million and also missed analysts’ estimates of $108.74 million. Beyond Meat saw a 40.1% year-over-year decline in sales from the U.S., primarily reflecting an overall fall in demand for meat alternative products. Headwinds such as persistent inflation, rising interest rates, and the possibility of a recession are impacting the volume of demand.

On the brighter side, the company reported a diluted loss of $0.83 per share, which outperformed the anticipated loss of $0.84 per share anticipated by analysts. Additionally, this is an improvement from the loss of $1.53 per share recorded in the previous year. The operational efficiency was attributed to “lower materials costs, lower inventory reserves, and lower logistics costs per pound.”

BYND Revises 2023 Outlook

Based on the headwinds mentioned above, the company sees subdued demand for its products in the second half of Fiscal 2023. Accordingly, FY23 net revenues are forecast to be between $360 to $380 million, representing a decline of between 14% and 9% annually.

Plus, operating expenses are forecasted at or below $245 million. Capital expenditures are projected to be between $20 and $25 million.

Additionally, owing to softer demand for plant-based meat products, the company withdrew its prior forecast of achieving cash flow-positive operations in the second half.

Commenting on the future pathway, President and CEO Ethan Brown said, “We remain steadfast in our belief that plant-based meat, and Beyond Meat specifically, will play an important part of the global response to a climate crisis that appears to be rapidly intensifying, while also delivering health benefits to the individual consumer.”

What is the Price Target for BYND?

Following the Q2 print, Goldman Sachs analyst Adam Samuelson reiterated a Sell rating on BYND stock with a price target of $4 (73.8% downside potential). The analyst also updated his model to reflect the revised outlook provided by the company.

On TipRanks, the average Beyond Meat price target of $9.13 implies 40.3% downside potential from current levels. The stock has a Moderate Sell consensus rating based on six Hold and four Sell ratings.

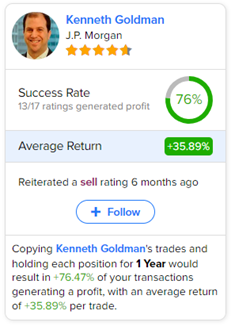

Moreover, investors looking for the most profitable analyst for BYND could follow J.P. Morgan analyst Kenneth Goldman. Copying his trades on this stock and holding each position for one year could result in 76% of your transactions generating a profit, with an average return of 35.89% per trade.