Overreactions can work in both directions, positive and negative. Traders who are hungry for quick profits are buying up Beyond Meat (NASDAQ:BYND) stock today, but they’re asking for trouble. After reviewing Beyond Meat’s actual results and plan for the future, I am bearish on BYND stock because I feel that there’s an overreaction happening now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Beyond Meat provides meat-free, plant-based food products, mainly to grocery stores and restaurants. Soon after the onset of the COVID-19 pandemic, some investors believed that Beyond Meat had a great future because consumers were focused on their health.

However, BYND stock has performed poorly during the past couple of years as the plant-based food craze didn’t necessarily translate to big profits. BYND stock is up 35% today (and up over 60% at one point near market open), though, but don’t place any hasty trades until you’ve learned the relevant facts about Beyond Meat.

Beyond Meat Posts a Wide Earnings Miss

How could Beyond Meat stock rally so much, even though the company missed Wall Street’s earnings estimate by a wide margin? That’s a mystery we’ll try to solve today.

Yesterday, after the market closed, Beyond Meat released its financial results for the fourth quarter of and the full year of 2023. First of all, the company’s quarterly net revenue of $73.7 million represented a decline of 7.8% year-over-year. When I look at Beyond Meat’s financials page on TipRanks, I can immediately see that the company hasn’t been growing its revenue during the past few quarters.

This problem, along with Beyond Meat’s margins, can help explain why the market hasn’t been hungry for BYND stock over the past couple of years. Speaking of margins, Beyond Meat disclosed that its gross profit “was a loss of $83.9 million, or gross margin of -113.8%” for 2023’s fourth quarter. That’s certainly not an ideal outcome, wouldn’t you agree?

The picture doesn’t look any brighter for Beyond Meat when we delve into the company’s bottom-line results. As it turns out, Beyond Meat incurred a Q4-2023 net loss of $155.1 million, or $2.40 per share. That’s much worse than the net loss of $66.9 million, or $1.05 per share, from the year-earlier quarter. It’s also a miss when compared to the consensus forecast that Beyond Meat would only lose $0.89 per share in 2023’s fourth quarter.

BYND Stock Spikes as CEO Promises Changes

Despite these less-than-ideal quarterly results, BYND stock spiked over 73% in after-hours trading yesterday and, as I mentioned earlier, is still up quite a bit today. Perhaps this occurred because Beyond Meat CEO Ethan Brown said on a conference call that the company would change from a “growth at all costs operating model to one that is highly focused on sustainability and profitability.”

This, presumably, involves raising product prices and cutting costs in order to boost Beyond Meat’s margins and possibly achieve profitability. That’s a risky proposition, though. It remains to be seen whether consumers are willing to pay more for Beyond Meat’s already pricey products.

Meanwhile, cost-cutting might help Beyond Meat get closer to profitability, but that’s a long and difficult road. As I mentioned earlier, Beyond Meat’s net loss has widened, so the company may have to cut a lot of costs.

Third Bridge analyst John Oh seemed to suggest that Beyond Meat is reducing costs because the company has to do this just to stay in business. “Our experts have told us that the company ‘needs to get in survival mode… The cost-savings initiatives and manufacturing optimization efforts are crucial for Beyond Meat given where the sector as a whole is currently,” Oh warned.

Mizuho analyst John Baumgartner also took a cautious tone. Baumgartner believes that Beyond Meat’s cost cuts and savings “are responses to precarious financials, given sharp sales declines and limited progress in expanding consumption beyond early adopters.”

Is BYND Stock a Buy, According to Analysts?

On TipRanks, BYND comes in as a Moderate Sell based on one Hold and three Sell ratings assigned by analysts in the past three months. The average Beyond Meat stock price target is $6.75, implying % downside potential.

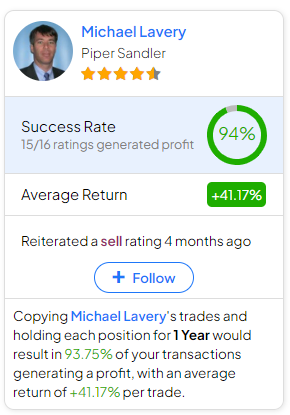

If you’re wondering which analyst you should follow if you want to buy and sell BYND stock, the most accurate analyst covering the stock (on a one-year timeframe) is Michael Lavery of Piper Sandler, with an average return of 41.17% per rating and a 94% success rate. Click on the image below to learn more.

Conclusion: Should You Consider BYND Stock?

Most likely, a short squeeze caused today’s spike in the Beyond Meat share price. Beyond Meat CEO’s hint at cost cutting may also be a contributing factor.

However, informed investors should take a close look at Beyond Meat’s actual results. The company’s revenue (which is declining), income (or lack thereof), and gross margin (which is deeply negative) indicate that Beyond Meat isn’t in ideal financial health. Consequently, after the surge of euphoric sentiment wears off, BYND stock will be vulnerable to a pullback, and I’m not considering owning it now.