These two Canadian dividend stocks are among the best stocks to buy in the week of April 15-19, as per analysts. Investing in dividend stocks is one of the best ways to diversify your portfolio and earn a regular stream of income. Dividends are paid from the distributable earnings that remain after making all other payments. Thus, dividend-paying companies often boast solid bottom lines and generate robust cash flows.

Let’s look at two companies, Gibson Energy (TSE:GEI) and Parex Resources (TSE:PXT), both of which have above-average dividend yields and a Strong Buy consensus rating.

Gibson Energy (TSE:GEI)

Gibson is an energy infrastructure company that stores, transports, markets, and distributes liquids. As of date, the company has 25.2 million barrels of storage capacity and more than 500 km of crude oil pipelines across North America.

Notably, Gibson pays a regular quarterly cash dividend of C$0.41 per share, reflecting a yield of 6.97%. The company increased its dividends by 5% for 2024, beginning with the April 2024 payment. Gibson has moderately increased its dividends in the past five years, showing the company’s resilience and ability to consistently reward shareholders.

In Fiscal 2023, Gibson’s revenue remained almost flat at C$11.01 billion compared to the previous year, while distributable cash flow grew 8% to C$386 million. Gibson has a targeted dividend payout ratio of 70%-80%, with the current rate standing at a lower level of 61%.

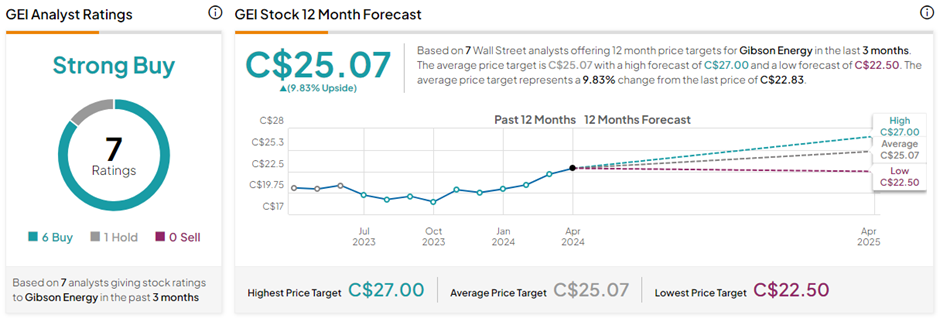

Is Gibson Energy a Good Stock to Buy?

With six Buys versus one Hold recommendation, GEI stock has a Strong Buy consensus rating on TipRanks. The average Gibson Energy price target of C$25.07 implies 9.8% upside potential from current levels. Meanwhile, GEI shares have gained 12.2% so far this year.

Parex Resources (TSE:PXT)

Parex Resources is the largest independent exploration and production company in Colombia. In the past year, PXT stock has lost 14.4%.

Parex has a solid dividend yield of 6.95%, represented by a quarterly cash dividend of C$0.375 per share. Moreover, the company continues to buy back shares, with the 2023 buybacks totalling 5% of outstanding shares.

In Fiscal 2023, average production rose 4% to reach 54,356 boe/d (barrels of oil equivalent). However, net income of $459.31 million fell about 25% compared to FY22. For FY24, Parex expects an average production of 54,000 to 60,000 boe/d.

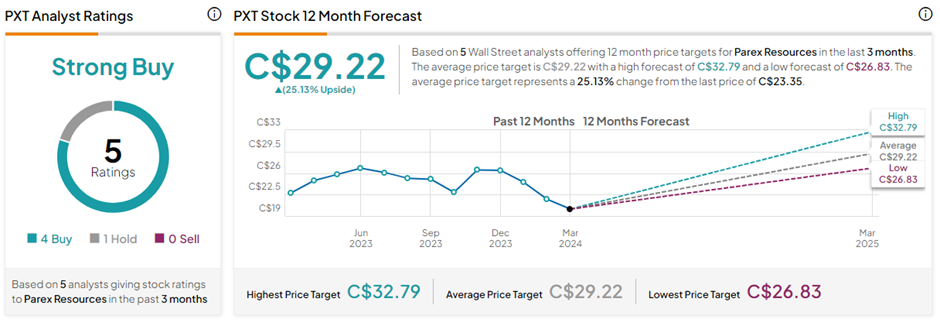

Is Parex Resources a Good Buy?

With four Buys and one Hold recommendation, PXT stock has a Strong Buy consensus rating on TipRanks. The average Parex Resources price target of C$29.22 implies 25.1% upside potential from current levels.

Ending Thoughts

Investors looking for a regular stream of income can consider the above two Canadian dividend stocks to boost their portfolio returns. Both stocks have earned a bullish view from analysts and are expected to offer an attractive upside over the next twelve months.