Insiders are selling large chunks of Berry Petroleum (BRY) while the company is simultaneously carrying out buybacks.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

BRY, an independent upstream energy company, had carried out an opportunistic stock buyback of two million shares worth $22.8 million in the month of May. The transaction took 2.5% of the company’s outstanding shares off the market and still left available repurchase authorization of more than $127 million in place.

Cary Baetz, CFO and Executive Vice President of the company, commented on the transaction, “We were approached by one of our largest shareholders with an opportunity to repurchase a significant number of shares which our Board approved, and we acted on. Based on the current oil strip price, the purchase price for these shares was an attractive return for the Berry shareholders.”

At the same time, the Tipranks insider tool highlights another trend. While BRY shares have gained almost 64% over the past 12 months and the buyback program is in place, major insiders have been offloading the company’s shares.

Over the last three months, insiders have sold BRY shares worth $47.2 million, which indicates a negative insider confidence signal for the stock.

In the last seven days alone, two major names that hold over 10% stake of the company have sold shares worth millions, and all of these Sells were informative.

This includes Oaktree Capital Management and Benefit Street Partners. Yesterday, Oaktree sold 664,674 BRY shares at $11.33 per share. Oaktree’s holding in the company now stands at around $138.8 million, representing a 15.14% stake.

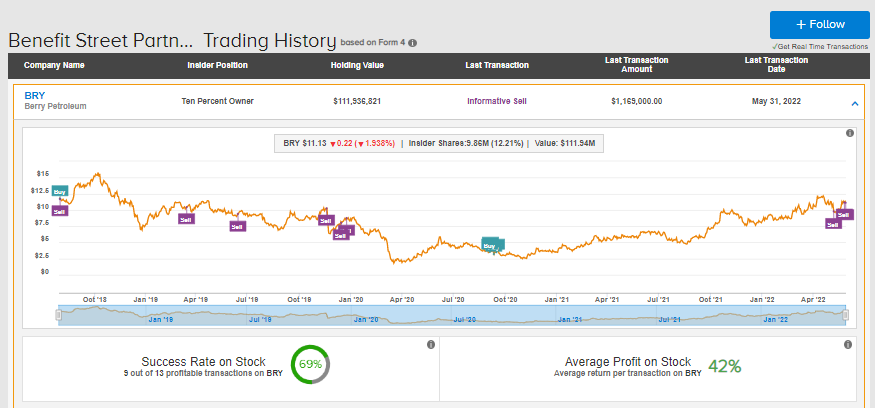

Meanwhile, Benefit has offloaded 841,000 BRY shares in the past week between $11 and $12 per share. Its holding in the company now stands at approximately ~$112 million, representing a 12.21% stake. Most importantly, Benefit’s nine out of 13 transactions in BRY shares have been profitable, with an average profit of 42%.

Analyst’s Take

While insiders have been busy at the company, the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on three Buys and a Hold. The average BRY price target of $14.13 implies a 26.95% potential upside.

Johnson Rice analyst Charles Meade is even more favorable on the stock with a Buy rating and a price target of $17.5, which implies a 57.23% potential upside.

Closing Note

These insider moves come at a time when the oil industry is reaping the gains of higher commodity prices. BRY, like its peers, has been undertaking efficient capital deployment measures such as buybacks to maximize shareholder value. Conversely, insider Sells may dampen investor sentiment about the stock.

Read full Disclaimer & Disclosure