Ice-cream maker Ben & Jerry’s has sued its parent company, Unilever (NYSE: UL) (GB: ULVR), over the sale of its Israeli business to a local licensee. Consumer goods conglomerate Unilever recently sold its Ben & Jerry’s business interests in Israel to Avi Zinger, the owner of American Quality Products Ltd., the current Israel-based licensee. Unilever made this deal to ensure that Ben & Jerry’s products will be sold under its Hebrew and Arabic names in Israel and the West Bank by the current licensee.

Additional Woes for Unilever

Unilever’s deal didn’t go down well with Ben & Jerry’s, which had ended the sale of its ice cream in the Occupied Palestinian Territory (OPT) last year, as it felt that the sale of its products in the region would be “inconsistent” with its values. However, Ben & Jerry’s clarified that it will continue to sell its products in Israel through a different arrangement.

Ben & Jerry’s decision to end its sale in West Bank settlements triggered a major controversy, with many U.S. state pension funds and entities deciding to divest their investments in Unilever. The ban was also heavily criticized by the Israeli government.

Unilever’s move to sell the Israeli business of Ben & Jerry’s was meant to put an end to the whole controversy. However, the matter gets even more complicated now with Ben & Jerry’s filing a lawsuit in a federal court in New York.

As per a CNBC report, Ben & Jerry’s stated in the lawsuit that Unilever’s decision was made without the approval of its independent board, which is responsible for protecting the integrity of its brand’s name.

The CNBC report further mentioned that on July 5, a judge denied Ben & Jerry’s application for a temporary restraining order. However, the judge ordered Unilever to provide justification by July 14 as to why a preliminary injunction shouldn’t be granted.

Wall Street’s Take

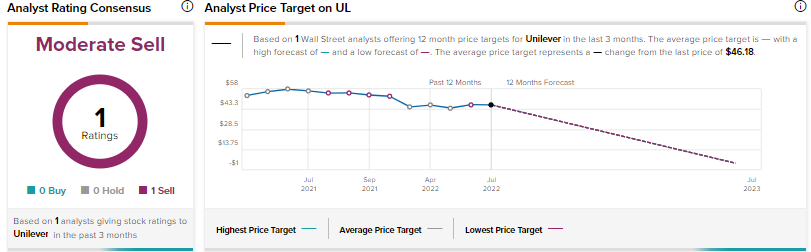

Back in May, Societe Generale analyst David Hayes downgraded Unilever to Sell from Buy and slashed the price target to £3,400 from £4,300, due to the “same concerns that have plagued our enthusiasm for much of the past three years.”

Hayes feels that the company’s hands “have now been tied”, and the risk of a structural sales deceleration and continued margin contraction are back in view.

Based on this recent rating review, Unilever has a Moderate Sell consensus rating.

Conclusion

The litigation filed by Ben & Jerry’s against Unilever creates more friction between the two entities and brings in additional trouble for the parent company. Given Unilever’s ongoing struggles with its top-line growth and weak margins as well as challenging business conditions, such issues involving controversial matters could distract the company and add to its problems. The price of Unilever stock trading on the NYSE is down 14.2% year-to-date.

Read full Disclosure