CRISPR gene editing technology presents a significant advancement in drug development. This revolutionary tool offers scientists the potential to treat and potentially cure genetic diseases by allowing them to modify the genes causing these illnesses. One of the companies on the cutting edge of integrating gene editing to develop treatments is Beam Therapeutics (NASDAQ:BEAM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The stock is down over 28% in the past month and 21% in the past year (see below). However, the sell-off is likely overdone, creating a window of opportunity for growth-oriented investors looking for a promising opportunity in this space.

Beam’s Base Editing Technology

Beam Therapeutics is a biotechnology firm that develops precision genetic medicines using its proprietary base editing technology. This technology allows the company to target a single base in the genome without causing a double-stranded break in the DNA. This innovative approach to gene editing paves the way for a new class of genetic medicines.

The company’s diverse pipeline includes several promising clinical candidates. BEAM-101 (currently in a Phase 1/2 trial) targets severe sickle cell disease, with the first clinical data expected in the second half of 2024. BEAM-302 (Phase 1 Trial), a treatment for patients with alpha-1 antitrypsin deficiency (AATD), is on track for the first half of 2024, following European Clinical Trial Application (CTA) acceptance.

This year, the company expects to launch its first in vivo clinical studies and report the first-in-human data from its ex vivo base editing clinical programs.

Looking Into Beam’s Recent Financials

In the fourth quarter of 2023, Beam’s research and development costs amounted to $140.1 million, culminating in $437.4 million for the financial year ending December 31, 2023. Net income for the quarter was $142.8 million, equating to $1.73 per diluted share. However, there was a net loss of $132.5 million, or -$1.72 per share, for the overall financial year ending December 31, 2023.

At the end of the fourth quarter of 2023, the company’s cash, cash equivalents, and marketable securities stood at $1.2 billion. The firm anticipates that this financial standing will support its operational plans into 2027. This projection considers funding channeled towards achieving milestones for BEAM-101, ESCAPE, BEAM-301, and BEAM-302, as well as progressive investments in platform advancements and manufacturing capabilities.

Is BEAM Stock a Buy?

Analysts covering the company have been cautiously optimistic about the stock. For example, Citigroup (NYSE:C) analyst Samantha Semenkow recently issued a Buy rating for Beam Therapeutics, setting a price target of $56.00. She believes Beam’s unique approach and ability to make significant clinical strides are catalysts for ongoing growth.

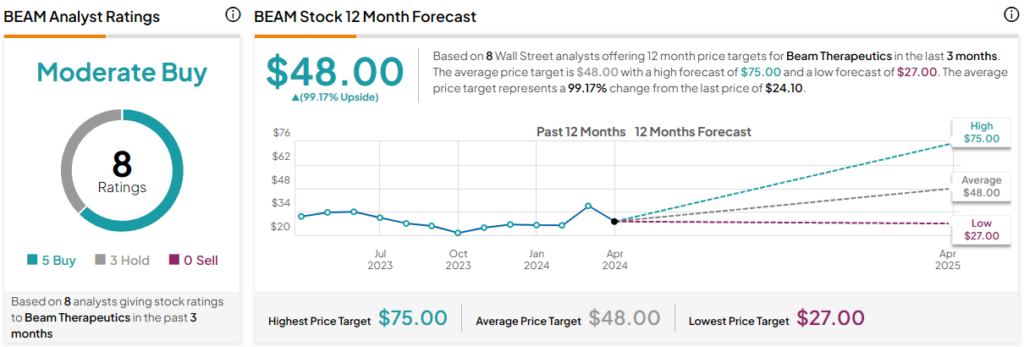

Beam Therapeutics is rated a Moderate Buy based on the recommendations and 12-month price targets of eight Wall Street analysts in the past three months. The average price target for BEAM stock is $48.00, which represents 100.84% upside potential from current levels.

Nonetheless, BEAM stock is highly volatile, recently climbing from $24/share to $45/share and back to $24/share this year. It demonstrates negative price momentum, trading below its 20-day (29.27) and 50-day (30.85) moving averages.

The Bottom Line on BEAM Stock

Beam Therapeutics is at the forefront of the revolution in genetic medicines, leveraging the power of gene editing technology. Positive developments later in the year among the company’s robust pipeline of clinical candidates could spark significant growth in the stock. The recent 28% plus dip in stock price seems like an overreaction, presenting an opportunity for investors seeking an entry point.

Beam’s unique approach and promising potential growth could make it an intriguing proposition for investors looking for a stock in this space.