Bausch Health Companies (TSE: BHC) (NYSE: BHC) swung to a profit from a loss in the fourth quarter of 2021. The manufacturer of health care products is fully ready to launch Solta and Bausch + Lomb IPOs.

Revenues & Earnings

Revenues came in at $2.196 billion for the quarter ended December 31, up 1% from $2.213 billion in the prior-year quarter.

The company reported a GAAP net income of $69 million ($0.19 per share) in Q4 2021, compared to a net loss of $153 million (-$0.43 per share) in Q4 2020.

Adjusted net income (non-GAAP) was $463 million for the fourth quarter, up from $478 million in the same quarter a year ago.

The company generated $24 million of cash from operations in Q4 2021, compared to $394 million in Q4 2020, a decrease of 94%.

CEO Commentary

Bausch Health chairman and CEO Joseph C. Papa said, “In 2021, our reported revenues grew by five percent as several of our key products gained market share, and we delivered on our near-term R&D catalysts with four new product launches. Thanks to the hard work and dedication of our employees, we achieved our goals in 2021 and have entered 2022 well positioned for continued growth. We have made great progress in our efforts to unlock value by creating three great companies, including publicly filing the registration statements for the proposed IPOs of Bausch + Lomb and Solta. Our planning and preparations to launch these IPOs are substantially complete, and we are prepared to move forward, subject to market conditions, stock exchange and other approvals.”

Wall Street’s Take

On February 16, RBC Capital analyst Doug Miehm kept a Buy rating on BHC and $34 (C$43.35) price target. This implies 49.5% upside potential.

As Doug Miehm is the only analyst to have offered a stock rating for BHC in the last three months, the average Bausch Health price target is C$43.35.

TipRanks’ Smart Score

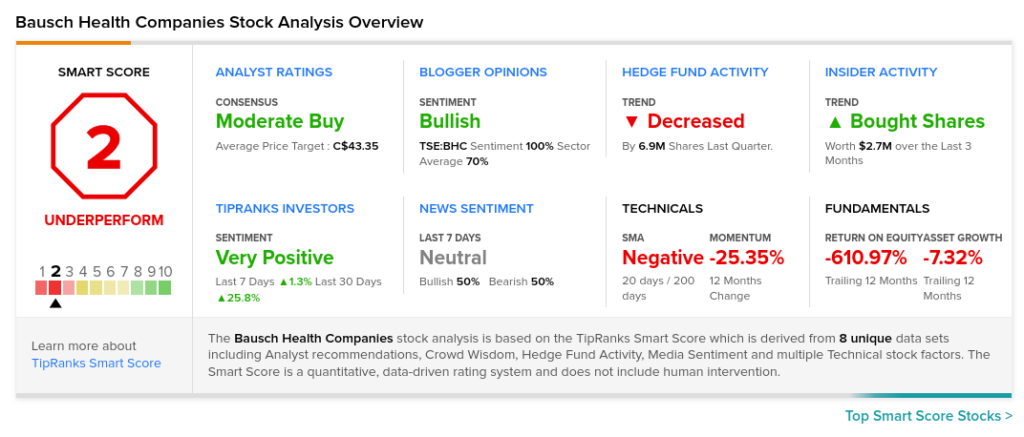

BHC scores a 2 out of 10 on the TipRanks Smart Score rating system, indicating that the stock is likely to underperform the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Dialogue Health Offers EAP to Scotiabank Employees

Moderna Signs Agreement to Sell COVID-19 Vaccine in Latin America

Nutrien Q4 Profit Rises Nearly 4x, Dividend Raised