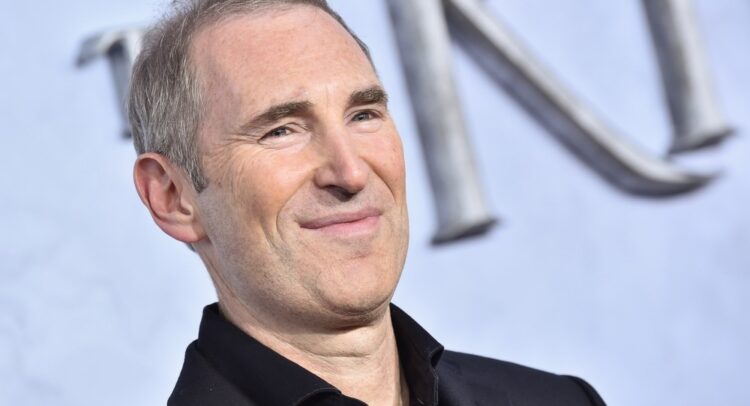

It might not feel like it, but 80% of global retail still happens offline, and more than 85% of IT spending is still on-premises, meaning there are still significant penetration opportunities for some of Amazon’s (NASDAQ:AMZN) main lines of business. These were just some points made by CEO Andy Jassy in his recent annual letter to shareholders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Assessing the letter, Bank of America’s Justin Post, a 5-star analyst rated in the top 1% of the Street’s stock pros, came away with a positive take.

“Constructive letter suggesting still low penetration in core markets, more retail margin efficiencies in 2024, Intl markets becoming more profitable, Cloud migrations picking up again, and strong Prime ad growth ahead,” Post opined.

Unsurprisingly, Jassy’s letter also included his views on AI, of which he said it may be the “largest technology transformation since the cloud.” He outlined what he calls its “three-layer stack strategy,” and suggested that exiting 2023 cloud migrations were “growing again.”

Elsewhere, on Prime Video, the company has reached over 200 million monthly viewers. Jassy believes the offering has the potential to become a “large and profitable business on its own.” This is down to the focus on exclusive content, marketplace initiatives (such as HBO on Prime Video), and the introduction of advertising within Prime Video. Jassy also pointed out that Sponsored Ads played a significant role in the 24% year-over-year growth seen in advertising revenue last year. For Post, it was comments around getting the business to profitability that “suggests big ad growth outlook.”

Regrading the fulfilment business, the continued benefits of regionalization were also highlighted, and for the first time since 2018, Cost to Serve fell YoY in 2023 (down $0.45 per unit), even as 70% more items were delivered same-day/overnight. The opportunity for further improvement in Cost to Serve in 2024 remains too, with a specific focus on “inbound fulfillment architecture and inventory placement.”

Overall, for Post, the letter addressed all the “must haves” for Amazon in 2024. “Continued retail margin improvement with opportunities for retail margins above 2018 levels in 2025, an improving Cloud market with attenuation in cost focus and migrations growing again (implying acceleration in revenue growth), and advertising upside potential from Prime,” the 5-star analyst said. “Positioning Amazon as better positioned for AI (given Azure concerns) is also positive for the stock valuation in our view, and perhaps the multi-model approach will have some advantages versus the perceived strength Azure with OpenAI.”

Accordingly, Post rates Amazon shares a Buy along with a $204 price objective. That figure implies potential upside of 11% from current levels. (To watch Post’s track record, click here)

Post is just one of many Amazon bulls on Wall Street. In fact, all analysts are behind this one; based on Buys only – 41, in total – the stock claims a Strong Buy consensus rating. At $210.92, the average price target offers room for one-year gains of ~15%. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.