Everyone has been busy watching Nvidia take off over the past year but meanwhile another semiconductor company has been putting the chip giant’s gains in the shade. Shares of Super Micro Computer (NASDAQ:SMCI) have delivered returns of a huge 1000% over the past 12 months.

Like Nvidia, Supermicro’s surge has been built on far more than mere hype with the server and storage systems specialist having benefited immensely from the rise of AI. To wit, the company’s latest quarterly readout featured handsome beats on both the top-and bottom-line and a revenue haul that more than doubled compared to the same period a year ago.

The obvious question for investors is whether now is the right time to be loading up, considering the stock’s huge outperformance. According to Bank of America analyst Ruplu Bhattacharya, the answer is yes.

“Our Buy rating is based on Super Micro’s strategic position in the growing AI server market and its competitive advantage in being able to customize designs and be an early launch partner for companies releasing CPUs and GPU accelerators,” the analyst said. “Our estimates are meaningfully above Street and we expect positive estimate revisions as we see continued revenue growth and share gains for the company.”

In fact, along with maintaining a Buy rating, Bhattacharya has raised his price objective from $1,040 to $1,280, although due to the massive gains, there’s now “only” room for 20% growth from current levels. (To watch Bhattacharya’s track record, click here)

That said, looking at the bigger picture and ahead to the next few years, Bhattacharya expects SCMI to take advantage of an industry growing at a faster pace than previously anticipated. Based on a revised analysis of the accelerator TAM, between 2023-2027, the analyst expects AI server industry revenue to increase from around $39 billion to about $200 billion.

Meanwhile, due to server demand from applications such as AI, High Performance Computing (HPC), big data analytics, engineering/technical workloads, streaming and content delivery, and compute-intensive graphics and online gaming, Bhattacharya anticipates SMCI will “continue to see strong revenue growth.”

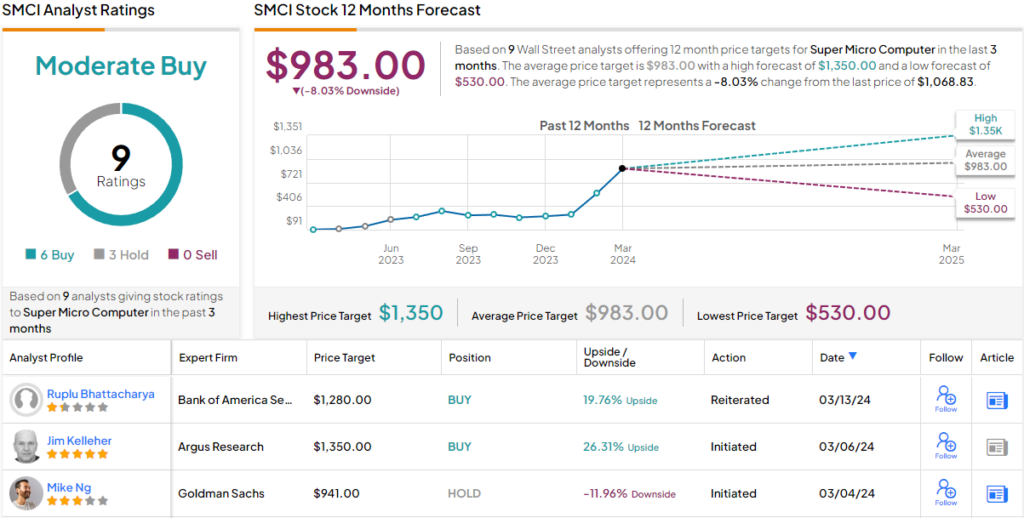

Amongst Bhattacharya’s colleagues, 5 other analysts join him in the bull camp while 3 remain on the sidelines with Hold ratings, making the consensus view here a Moderate Buy. That said, several analysts think the shares have overshot, hence the $983 average target factors in a 12-month decline of an 8%. It will be interesting to see whether some analysts upgrade their targets should the stock keep up the momentum. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.