A holiday season afoot, and consumer tech giant Apple (NASDAQ:AAPL) releasing new products? Sounds like it should be days of wine and roses for Apple, but that doesn’t seem to be the case. Despite some flowery words from Bank of America, the bloom is off the rose as Apple dropped nearly 2% in Tuesday afternoon’s trading session.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The word from Bank of America analyst Wamsi Mohan should have been better news. So far, demand for the iPhone 15 is on par with expectations, but there are signs that the Apple Watch will do better than expected. That’s based on the trade-in values seen so far on the device, suggesting that there’s a premium to get used models into stores. There was a “quick decline” on iPhone demand, but iPhone availability is likely partially factored in.

One major problem facing Apple, reports note, is the growing body of complaints emerging around the FineWoven case line. Apple recently released a memo calling on employees to address complaints by essentially acting like a commercial for the product, pointing out its “luxurious microtwill” and “soft yet durable suedelike nature.” Any decline in quality is simply the result of fibers being compressed, the memo asserts. Throw in reports of iPhone 15 models overheating and reaching temperatures of up to 116 degrees Fahrenheit and it’s not exactly a good look overall.

Is Apple a Buy or Sell?

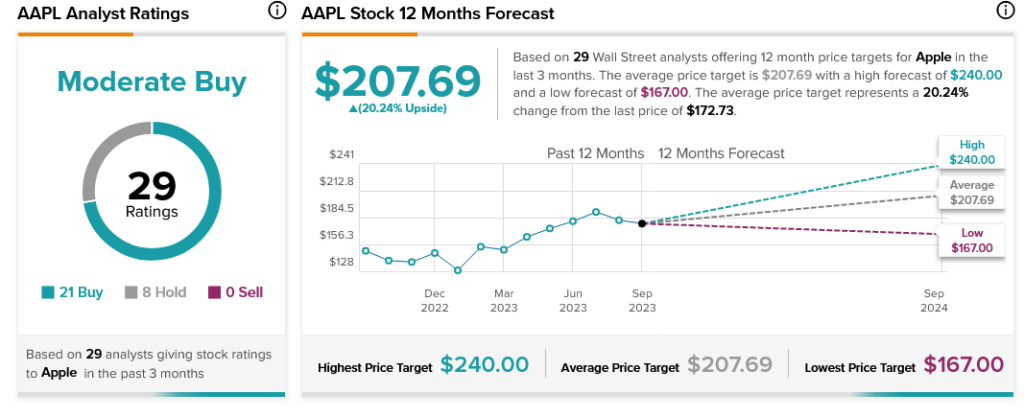

Analysts, meanwhile, are sticking to their guns on Apple. Apple stock is currently considered a Moderate Buy, thanks to 21 Buy ratings and eight Holds. Further, with an average price target of $207.69, Apple stock offers investors 20.24% upside potential.