Shares of tech giant Apple (NASDAQ:AAPL) are up today after Morgan Stanley’s latest report indicated that the iPhone 15 is seeing remarkable demand. As of Friday, lead times for the device reached record peaks in North America, a promising sign, especially after a lukewarm initial reception. Analyst Erik Woodring, who has a Buy rating on Apple with a $215 price target, commented that the next couple of weeks will be pivotal.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Based on historical patterns, lead times for new iPhones typically expand in the initial week post-launch and then stabilize. With the iPhone 15 Pro Max supply projected to improve soon, Woodring believes it’s essential to monitor its lead times and early demand to forecast Apple’s production plans.

Woodring also underscored some significant stats: the iPhone 15 Pro Max has a staggering 45-day lead time in the U.S. and 47 days globally, reflecting the longest wait over the past seven years due to supply constraints and sturdy demand. Meanwhile, the iPhone 15 Pro, despite no supply restrictions, has a lead time of 35 days in the U.S. and 36 days globally – the lengthiest for a Pro model in half a decade. Lastly, the base iPhone 15 models exhibit the second-longest lead times in four years, hovering around 16 to 17 days.

Is AAPL Stock a Buy?

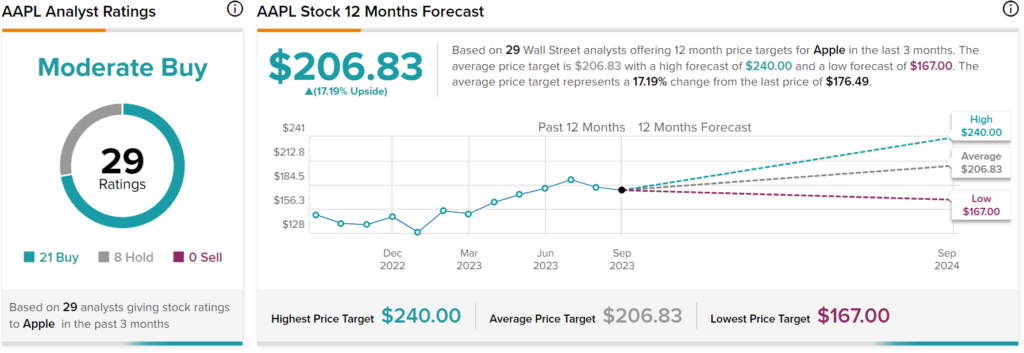

Overall, analysts have a Moderate Buy consensus rating on AAPL stock based on 21 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $206.83 per share implies 17.19% upside potential.