The EV industry is going through a rough patch, with companies across the spectrum affected by the downturn. While legacy auto makers have also been having a hard time, for the newer upstarts attempting to ride the secular trend and gain a foothold on the EV ladder, it has been even more difficult, with many struggling to meet their prior targets.

One prime example of this struggle is Nikola (NASDAQ:NKLA), an electric truck manufacturer, whose shares have plummeted by 74% in the past year.

However, one Street analyst sees opportunity here. Baird’s Ben Kallo believes Nikola is well-equipped to weather the EV storm and sees the company as well-positioned to take share.

“We see significant potential in the market for zero-emissions trucking and believe NKLA has finally found the right management team to capitalize on the opportunity,” the analyst said. “NKLA’s proprietary design and software are key differentiators vs traditional diesel trucks in our view, and we see potential catalysts ahead for both the Truck and Energy businesses in the form of manufacturing improvements, customer and partnership announcements, and hydrogen infrastructure buildout.”

Standing in Nikola’s stead is the fact its tech allows for long-haul trucking for both fully electric and fuel cell vehicles. Its powertrains are purchased from FPT Industrial (a subsidiary of partner Iveco Group) while the design of the software, vehicle torque, controls, and other specialty components are kept in-house. The trucks come equipped with Nikola’s proprietary software, which boasts a number of patented (or patent pending) features, making its value proposition vs. traditional trucks “underappreciated.”

Additionally, following a series of shifts in leadership, Steve Girsky took over the position of CEO last August and brought on board various C-suite members. So far, he is doing a good job, says Kallo, with the management team being put together representing a “positive for the stock.” A near-term catalyst could also come from the appointment of a new CFO.

Investors should also keep an eye out for customer announcements and production improvements on the truck side of the business while the stock could also benefit from state or federal incentive programs in new regions.

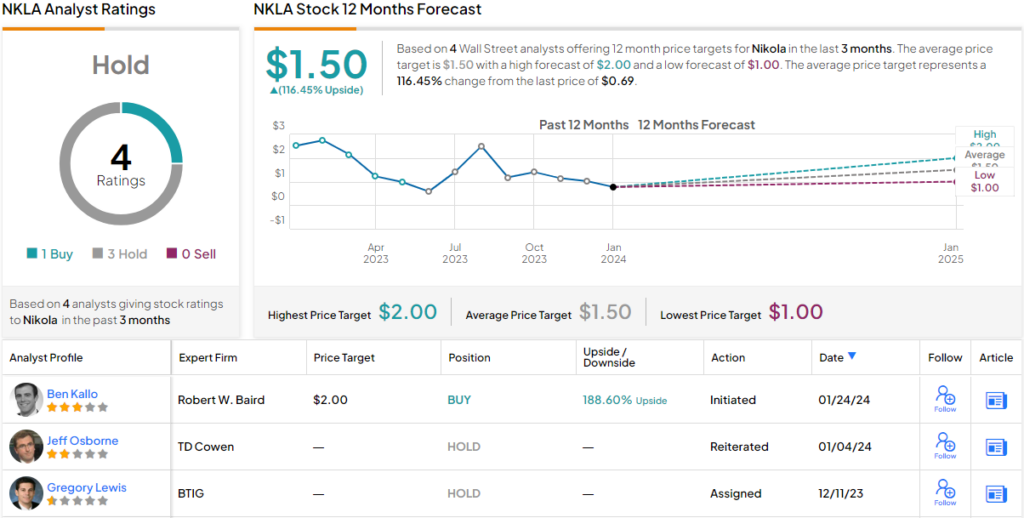

Bottom-line, Kallo initiated coverage of Nikola with an Outperform (i.e., Buy) rating and $2 price target, suggesting big upside of 189% from current levels. (To watch Kallo’s track record, click here)

The Street’s take here offers a bit of a conundrum. On the one hand, based on 1 Buy vs. 3 Holds, the analyst consensus rates the stock a Hold. However, some skeptics might as well have said Buy, as the $1.50 average target makes room for one-year returns of a strong 116%. (See Nikola stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.