Shares of Chinese multinational technology company Baidu, Inc. (BIDU) slipped 5.5% on Wednesday after the company missed revenue estimates for the third quarter of 2021. The stock lost another 0.3% in the extended trading session to end the day at $161.40.

Headquartered in Beijing’s Haidian District, Baidu offers Internet-related services and products and artificial intelligence (AI).

Earnings and Revenue

Adjusted earnings declined 28% year-over-year to $2.28 per share but beat the Street’s estimate of $2.07 per share.

Total revenues increased 13% to $4.95 billion and fell just short of analysts’ expectations of $4.99 billion.

Segment Revenues

Revenue from Baidu Core grew 15% year-over-year to $3.83 billion with online marketing revenue rising 6% to $3.02 billion and non-online marketing revenue up 76% to $806 million.

Revenue from iQIYI jumped 6% to $1.18 billion. (See Insiders’ Hot Stocks on TipRanks)

Other Highlights

During the quarter, while adjusted EBITDA amounted to $925 million, cash, cash equivalents, restricted cash and short-term investments totaled $30.20 billion.

Management Comments

The CFO of Baidu, Rong Luo, said, “With a diversified AI portfolio, including cloud services, smart transportation, smart devices, self-driving, smart EV and robotaxi, we are well-positioned for long-term growth.”

Outlook

Baidu expects revenues in the range of $4.81 billion to $5.27 billion for the fourth quarter of 2021, reflecting year-over-year growth of 2% to 12%.

Analyst Recommendation

Overall, the stock has a Moderate Buy consensus rating based on 9 Buys, 1 Hold and 1 Sell. The average Baidu price target of $246.11 implies 52.1% upside potential. Shares have lost 25.4% year-to-date.

Website Traffic

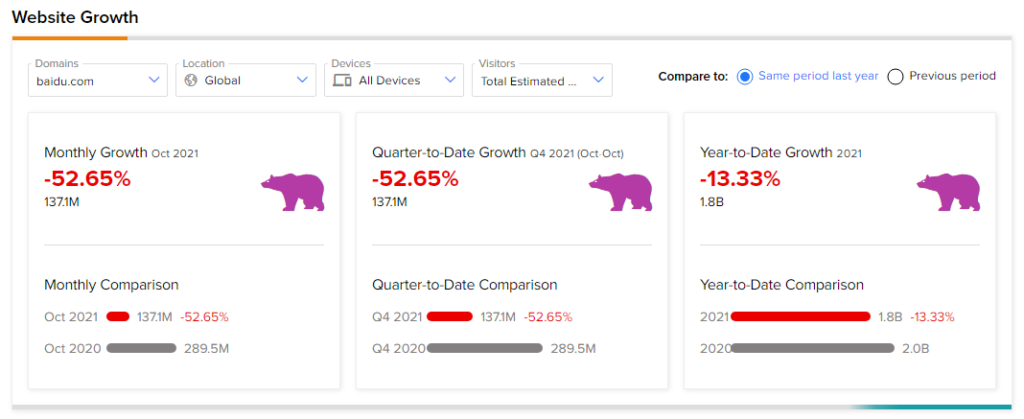

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Baidu’s performance.

According to the tool, the company’s website traffic registered a 52.65% decrease in global visits in October. Moreover, website traffic has declined 13.33% year-to-date.

Related News:

Real Matters Posts Lower Q4 Profit, Shares Dip

HP Inc. Raises Quarterly Dividend by 28.2%

Lowe’s Gains on Strong Q3 Results