Shares of AutoZone (AZO) fell 2% on Tuesday after the company reported Q4 revenue and earnings, missing Wall Street estimates. This marked the fifth consecutive quarter that AutoZone missed earnings expectations, with adjusted earnings of $48.71 per share, down from $51.58 per share a year earlier. Wall Street had expected $50.59 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, AutoZone is a U.S. retailer and distributor of automotive parts and accessories. The company serves both DIY customers and professional mechanics through its stores and online platform.

Rising Tariffs Fuel AutoZone Sales Growth

Despite lower profits, AutoZone reported a 4.5% increase in same-store sales, boosted by higher prices due to tariffs. Overall, the company posted $6.24 billion in sales, slightly up from $6.21 billion a year earlier, just shy of analysts’ $6.25 billion forecast.

Earlier this year, a 25% tariff on imported cars and parts helped the company boost prices. Since car repairs are often essential, higher prices haven’t reduced demand. Meanwhile, higher new-car costs also pushed more people to repair their current vehicles, benefiting parts retailers like AutoZone.

For the quarter, gross profit was 51.5% of sales, down 98 basis points from last year. The decline was mainly due to an $80 million non-cash LIFO charge (compared to none last year), partially offset by higher merchandise margins. Notably, a LIFO charge is a non-cash accounting adjustment, which reduces reported profits on paper but does not involve actual cash leaving the company.

AutoZone’s Outlook

Looking ahead, the company didn’t provide a 2026 forecast but said it plans to expand its store network. CEO Phil Daniele stated that the company expects to open many new stores to grow its market share.

Earlier this month, UBS analysts noted that AutoZone is investing heavily in stores, fleet, supply chain, staff, and technology. While these investments put pressure on margins in the short term, they are boosting sales growth and are expected to improve profitability over the long term.

Is AutoZone a Good Stock to Buy Right Now?

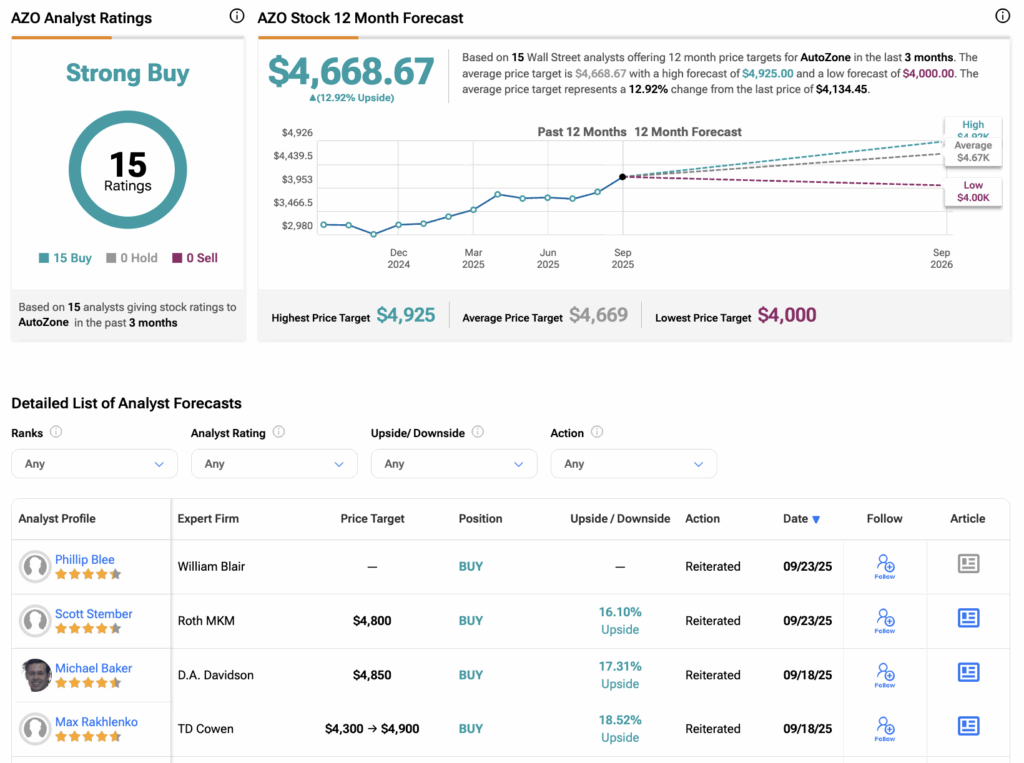

Turning to Wall Street, analysts have a Strong Buy consensus rating on AZO stock based on 15 Buys assigned in the past three months. At $4,668.67, the average AutoZone stock price target implies an 13% upside potential.

These ratings and price targets will likely change after analysts update their coverage following today’s earnings report.