On Dec. 23, Ayr Strategies announced the acquisition of CannTech PA for $57.4 million.

AYR Strategies’ (AYRWF) purchase consideration consisted of $27.2 million in cash and $15 million in exchangeable shares.

The acquisition includes a 143,000 sq. ft. cultivation and processing facility on 13 acres. Additionally, the first phase of the planned build-out of the facility is complete and permitted for cultivation.

CannTech’s license allows up to six dispensary locations in Pennsylvania, including the recently announced opening of its first dispensary in New Castle, PA.

The company intends to open two additional stores in Q1, with three other PA dispensary openings scheduled for 2H21.

Four of these additional dispensaries will be clustered in the Pittsburgh and Philadelphia metropolitan areas, while one will be in Erie, PA.

“We are thrilled to have completed our second acquisition and solidified our entry into Pennsylvania. It is a rapidly growing, but under-supplied medical market, and we look forward to bringing our cultivation, processing and retail expertise to the Commonwealth to improve patients’ access to quality cannabis,” said Ayr Strategies CEO Jonathan Sandelman.

“With adult-use possible in the foreseeable future, we are well positioned with large-scale cultivation and processing capabilities to lead in both the retail and wholesale markets, as we have done in Nevada and Massachusetts. We are looking forward to welcoming the Pennsylvania team to the Ayr family and to the exciting opportunities ahead in 2021 and beyond,” Sandelman added.

The above announcement came just a day after its proposed acquisitions in Florida and New Jersey. Liberty Health Sciences (LHSIF), a vertically integrated operator in Florida, would be acquired in a stock-for-stock transaction for $290 million. The membership interests in GSD NJ, a licensed operator in New Jersey, would be acquired for $101 million.

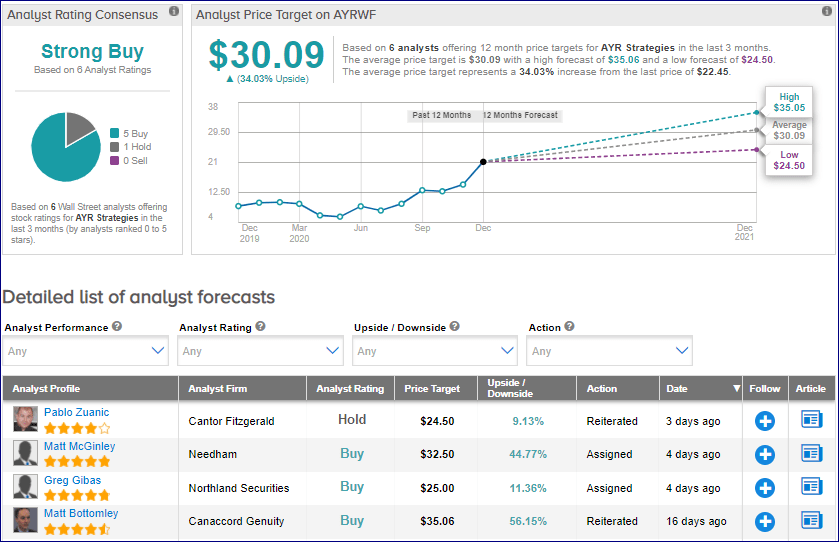

In reaction to the deals worth $490 million to enter the “attractive” Florida and New Jersey markets and expand its footprint to seven U.S. states, Cantor Fitzgerald analyst Pablo Zuanic raised the price target on AYRWF from $24 to $24.50 and reiterated a Hold rating on Dec. 24. The new price target implies a 9% upside potential.

Incumbent U.S. multi-state operators will have a window in which to consolidate the industry, and “certainly some are likely to be bolder than others,” said Zuanic, who added that AYR is “an MSO to watch in the year ahead.” (See AYRWF stock analysis on TipRanks)

Multi-state operators (MSOs) are cannabis companies that have a reach across multiple legal cannabis states.

Shares of the cannabis operator rose 3.5% at the close on Dec. 24.

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 5 Buys and 1 Hold. The average analyst price target of $30.09 implies upside potential of 34% to current levels.

Related News:

Gazprom Says Production is Set to Decline; Street Sees 6% Downside

Rio Tinto and PKKP Rebuild Relations After Juukan Gorge Destruction; Shares Up 28% YTD

Mastercard Sees Shift in Online Spending as U.S. Retail Sales Grow 3%