Axis Capital Holdings estimated a preliminary net pre-tax loss in the range of $225 million to $255 million, or $190 million to $220 million after-tax in 3Q related to catastrophes and other events. The specialty insurance and reinsurance provider will report its 3Q results on Oct. 28.

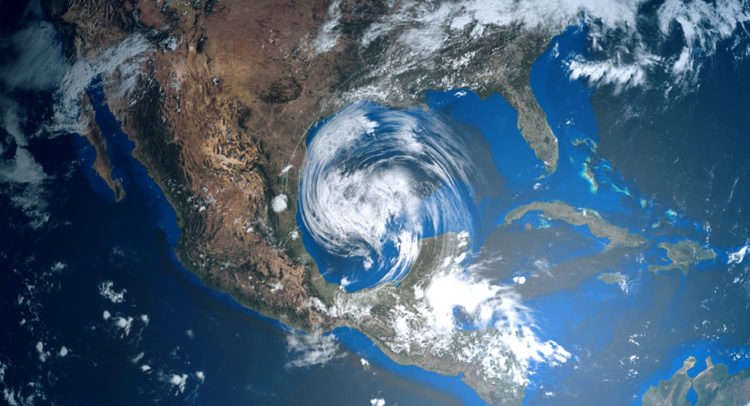

Axis Capital (AXS) said “This net loss estimate relates to Hurricanes Laura and Sally, the Midwest derecho, wildfires across the West Coast of the United States, the Beirut explosion and regional weather events in the United States, and is attributable to the Company’s insurance and reinsurance segments.”

Excluding catastrophe and weather-related losses, Axis saw improving trends in current accident year loss ratios, consistent with the first half of 2020. Furthermore, the company said its pricing across most insurance business improved significantly. (See AXS stock analysis on TipRanks).

Following the preliminary estimates, Wells Fargo analyst Elyse Greenspan updated 3Q EPS estimate to a loss of $0.73 (from a loss of $1.47) and 2020 EPS estimate to a loss of $0.63 (from a loss of $1.38) due to the “lack of Covid-19 losses”. Greenspan said “Our pretax cat [catastrophe] estimate included $200 million of natural cats and $105 million from Covid-19.”

Greenspan maintains a Sell rating on the stock with a price target of $41 (7.7% downside potential), as the analyst believes “AXS to be more constrained from a price performance perspective relative to its (re)insurance peers.” She added that the company’s risks include “reporting worse than expected underlying margins, a slowdown in reserve releases, and expense saves from Novae fail to materialize.”

Currently, the Street is sidelined on the stock with a Hold analyst consensus. The average price target of $49 implies upside potential of about 10.4% to current levels. Shares are down by about 25.3% year-to-date.

Related News:

Fastenal Dips Over 5% On 3Q Revenue Miss

BlackRock Gains 4% On 3Q Profit Beat; Street Says Buy

J.P. Morgan Surprises With 3Q Profit Beat Fueled By Capital Markets Boom