Axcelis Technologies (NASDAQ:ACLS) is experiencing a surge in demand, particularly from manufacturers of critical components for the booming electric vehicle (EV) and AI semiconductor industry, trends that are not going away soon. Despite impressive growth over the past few years, ACLS share price has languished recently, creating a value opportunity for tech investors looking to access the AI/EV boom.

Rising Demand in EV and AI Manufacturing

Axcelis specializes in the design, manufacture, and service of dry-strip systems, ion implantation, and other processing equipment used in the production of semiconductor chips. Products include the next-generation single-wafer high-current and high-energy implanters, Purion H and Purion XE, respectively.

In response to current market trends, Axcelis is seeing a substantial increase in demand from producers of silicon carbide power devices. These devices are integral to the EV industry due to their efficiency over traditional silicon chemistry, resulting in higher mileage per battery charge and faster charging times.

Strong customer demand for its Purion suite of products has propelled the company’s top-line performance. In 2023, Axcelis generated a record $1.13 billion in revenue, reflecting a 22.9% year-over-year increase. It ended the year with a sizeable $1.2 billion order backlog, indicating a promising outlook for 2024. Additionally, Axcelis is preparing for increased demand from manufacturers of AI-related semiconductors.

Axcelis’ Lower Expectations for Q1 2024

Axcelis’ revenue in Q4 rose to $310.3 million from $292.3 million in the third quarter, with EPS of $2.15 per diluted share, compared to $1.99 in Q3. The gross margin remained consistent at 44.4% across the fourth and third quarters.

However, management’s future outlook suggests a lower EPS and revenue for Q1 2024, sitting at $1.22 and approximately $242 million, respectively, with the consensus for Q1 at $1.83 and $284.9 million. Despite the slow start, the company expects full-year 2024 revenue to be on par with 2023, with a more significant revenue share anticipated in the second half.

Attractive Valuation

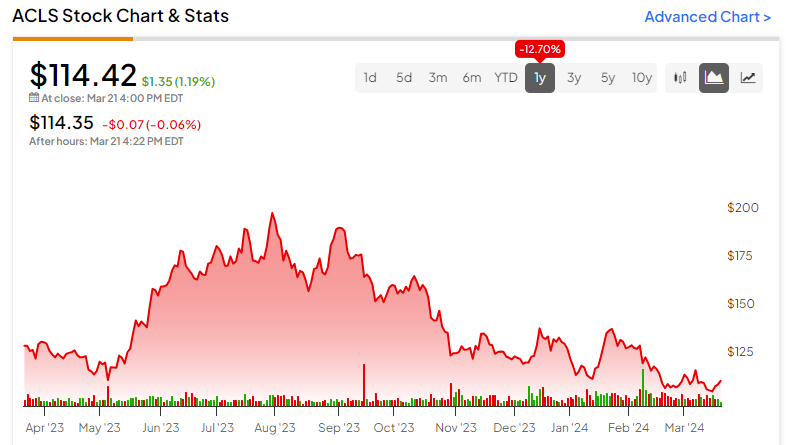

Over the past five years, Axcelis stock has appreciated over 450%, though that trend has reversed somewhat, with the stock pulling back roughly 13% in the past year. It is trading near the bottom of the 52-week range of $105.28-$201.

However, with the recent price drop, ACLS stock trades at an attractive valuation. Its P/E ratio of 15.40x is well below the Technology sector average of 32x, the Semiconductor Equipment and Materials industry average of 36.43x, and the stock’s historic average of 24.50x. P/S, P/FCF, and EV/EBITDA all exhibit the same pattern.

Is ACLS a Buy, Sell, or Hold?

Analysts covering ALCS stock have taken a cautiously optimistic stance. For instance, B. Riley analyst Craig Ellis lowered the firm’s price target on Axcelis to $165 from $180 while keeping a Buy rating on the shares, citing the weaker-than-expected Q1 guidance.

ACLS is currently listed as a Moderate Buy based on six analysts’ stock ratings in the past three months. The average Axcelis price target of $152.50 represents an upside potential of 33.28% from current levels.

Capitalizing on ACLS’ Undervaluation

Despite navigating a challenging industry landscape, Axcelis Technologies has managed to enhance its margins and realize strong top-line growth. Further solidifying its financial standing, the firm boasts a debt-free balance sheet complemented by a healthy pool of cash reserves.

Even though the management’s near-term guidance has left analysts wanting, the recent dip in the company’s stock price provides an excellent entry point for potential investors. Given Axcelis’ industry position and robust financial health, this could be an opportune moment to capitalize on the stock’s undervaluation.