EV maker Tesla (TSLA) may have reported forecast-beating Q3 revenues, but for investors it is time for chief executive Elon Musk to do “less thinking and more doing.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

No Cash Bonanza

Kathleen Brooks, research director at XTB, said the drop in shares post-result was partly down to investors frustrated by the company’s aims and structure.

She pointed out that the earnings report revealed a stronger-than-expected gross margin of 18% beating forecasts of 17.2% and free cash flow of $4 billion last quarter. It means, she said, that Tesla is now sitting on a $41.6 billion cash pile.

“This is a serious chunk of change, however, there were no investor sweeteners included in this earnings report. Tesla does not pay dividends, and it has never executed a share buyback programme,” she said. “Understanding why Tesla does not want to give back excess cash to shareholders, we need to understand Elon Musk’s mindset. He said that people should think of Tesla as a dozen startup companies in one. No wonder the stock price is volatile after this earnings report: anyone looking for Tesla to act like other blue chips will be disappointed.”

Doubter or Believer?

She added that Tesla does not work on the repeat model of sales, revenues, cash and buybacks. “Instead, it is a traditional growth company that runs on ideas. If you believe in the ideas of Elon Musk, then you should buy Tesla stock, if you don’t then you should avoid it,” she said.

The question investors need to ask themselves when considering Tesla stock is whether they are willing to pay for Musk’s big ideas such as humanoid robots to come to life.

“In the current environment, where investors remain nervous about geopolitics and the global economic outlook, the vision and ideas that Musk is selling may not take off,” she said. “Musk is likely to have failed to make progress to persuade less enthusiastic investors, who would rather Musk did a bit less thinking and a lot more production. There is much skepticism.”

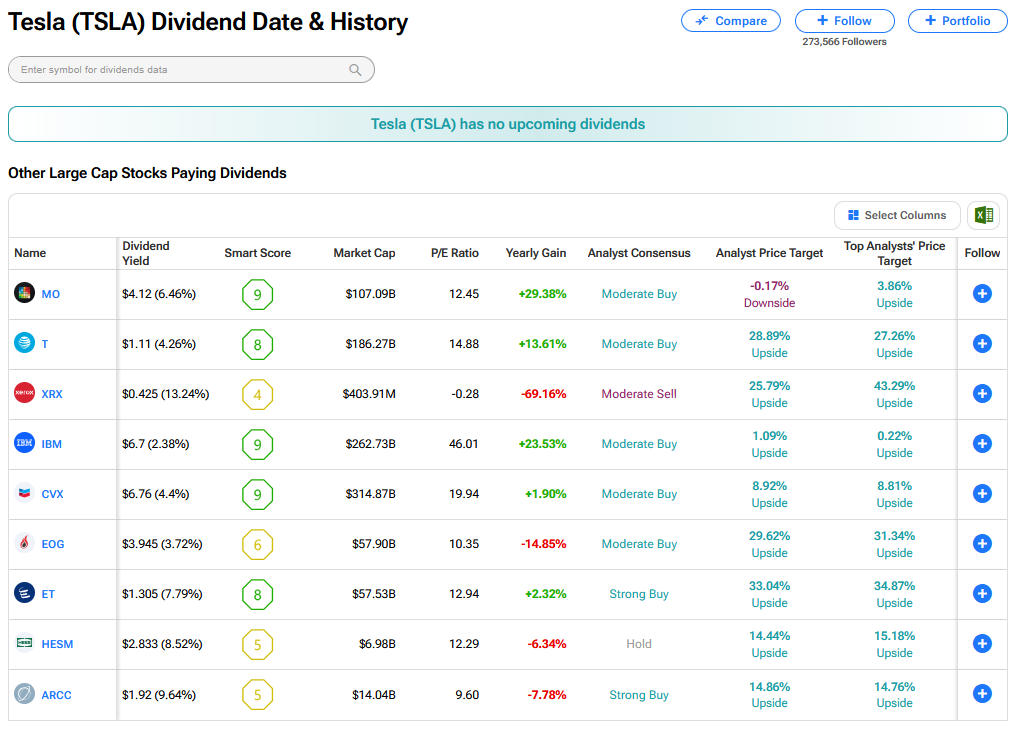

What Large Stocks Are Paying Dividends?

Let’s have a look at blue-chip stocks who are rewarding their shareholders with dividends.